Jasper: Delivering connected car services that consumer will pay for

Consumers have well-established digital lives outside the vehicle. Rather than trying to develop an entirely new series of billing relationships, vehicle owners should be able to extend their car into the monthly recurring service fees they currently have established.

Paul Drysch, Global Director-Connected Car | Jasper

In the next five years over 75% of new cars globally will ship with some form of built-in Internet connectivity. The aggressive rate of adoption is driven both by consumer demand and regulation. This prevalence of in-vehicle connectivity will, in turn, spawn a new range of service offerings and business opportunities to monetize these connections.

The developed world has seen connected cars in the mainstream since OnStar began incorporating the service into GM cars in the mid-1990’s. Today in North America and much of Europe, connected cars and their capabilities have caught on as a necessary piece of functionality. These connected capabilities are now driving vehicle preference with a generation of buyers who consider the vehicle as the next consumer electronics device.

In many parts of the world, embedded telematics will often be driven by government regulations – specifically for safety and security. In Russia, ERA-GLONASS mandates that all new vehicle models introduced after 2016 be equipped with embedded connectivity designed to aid with emergency vehicle assistance. In Brazil the CONTRAN 245 regulation (SIMRAV) requires embedded connectivity to help abate the stolen vehicle crisis with built-in, always-on vehicle tracking. And in the EU,eCall regulation is driving embedded connectivity throughout the complete model range of vehicles sold after March 2018 to provide automatic assistance in the event of an accident.

As embedded connectivity moves from a first world luxury option to a standard feature in entry level models in both developed and developing economies, auto manufacturers will need to adopt new business models reflecting a much more diverse global consumer.

The ‘bundling’ of telematics services has traditionally been the prevalent pricing model for subscription services. Cable companies offer packages with hundreds of channels for only a little more than the price of packages that only contain the premium channels. While this is an accepted business practice in the developed world, in economies where customers are price sensitive, this approach breaks down. Rather than being perceived as a good value, the opposite is often true with customers wondering why they are paying a premium price for services that they aren’t using.

New business models will become critical to the long-term global success of automotive connected services. Possibly the most basic of these monetization models is to offer those services which have marginal monthly cost to the OEM, for free to the consumer (included with the price of the car). By doing so, this can help the manufacturer to sell more cars. In fact, AT&T has estimated that half of all drivers would switch brands to a comparable brand in order to get connected car services.

In the same way that Amazon includes cellular connectivity with their connected Kindle devices and monetizes those connections through the purchase of new books and media content, offering a pay-per-use model for vehicles lets customers pay for a service only when they need it. For example, rather than charging a monthly fee for a remote unlocking service (whether or not it’s used), offering car owners the option to be charged a one-time door unlock fee each time they lock their keys in the car means extracting the most value from a situation where the willingness to pay is highest. While some consumers will gladly pay for the traditional package, others will prefer the pay-per-use model. In the end, the car company and the consumer both win through new adoption of additional business models.

Consumers have well-established digital lives outside the vehicle. Rather than trying to develop an entirely new series of billing relationships, vehicle owners should be able to extend their car into the monthly recurring service fees they currently have established.This reduces the barriers to entry for using connected services. No new billing relationship is needed if the car can be added to an existing family plan for a small additional monthly fee, so it can dip into the same pool of monthly data that the rest of the family members share. Extending existing streaming music subscriptions to include playing in the car without requiring the customer to sign up for in-car internet means that services can selectively use the connectivity without requiring a dedicated connectivity fee.

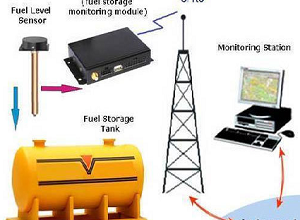

Of course, this requires some sophistication from the auto OEMs and their wireless operators in order to effectively split the data being used into wholesale usage that an OEM pays for, bundled services, and services where the service provider pays for the data used and then manages the customer billing relationship directly. And this is why most auto manufacturers choose to work with an Internet of Things (IoT) platform provider to help them deploy, manage and monetize these new services.

Ensuring that the right services are available is another major step forward that automotive OEMs will need to undertake. Developing a service/app ecosystem that focuses on convenience, productivity and entertainment will drive demand. Cell phones and tablets didn’t gain widespread adoption by consumers until there was enough content and apps to grab people’s interest. While the car needs a ‘walled garden’ approach in some areas to prevent tampering or viruses, there also needs to be an open space that will allow creative app and content providers to flourish. When that happens, consumers will want a connected car and will gladly pay for it.

Sales models will also need to evolve with connected services. It’s no longer enough for a customer to test drive the vehicle. Now they will need to test drive the services too. This means that in the dealership, services need to be on and fully functional prior to vehicle sale. And after the owner drives off the lot, those services should still work for free during a trial period to ensure that drivers are exposed to these new services and experience the value for themselves.

Getting users to sign up after the trial is the moment of truth for a connected service. In working with 13 of the world’s largest OEMs, our data shows that the average sign-up rate for a service plan in a connected car is about 40%. One method proven to increase the take-rate is to require the new owner to enter their authorized credit card in order to get access to the free trial. Then when the service expires, the customer can either opt out of the service or simply activate the service with one touch (similar to how they purchase items on iTunes or Kindle). This ensures that when the time comes to use the service, it’s as simple to activate as possible.

Today’s customer already desires to integrate their smartphone experience into the car, and while tethered solutions still have their place, embedded telematics services provide consumers with a much richer experience. That enhanced, premium experience – enabled by embedded telematics and the advanced IoT service platforms that help deliver consistent services worldwide – is what consumers will pay for. Not only does this enhance the customer’s experience throughout the life of the vehicle, but it strengthens the manufacturer’s understanding of and relationship with the customer while enabling them to unlock new, ongoing revenue streams.