India

India’s EV sales surge due to low costs and policy support

The Bloomberg New Economy Forum, under the auspices of Bloomberg Finance L.P., has produced an study on the Sale of Electric Vehicles (EVs)in India. Sales of electric vehicle grew across all segments in India 2023, backed by a combination of factors including lower lifetime ownership costs, the availability

of more models and purchase subsidies. Efforts to improve the network of fast EV chargers are also expanding with state-owned fuel retailers at the forefront. The federal government has introduced a spate of policies that will help sustain sales and attract more investment to the sector.

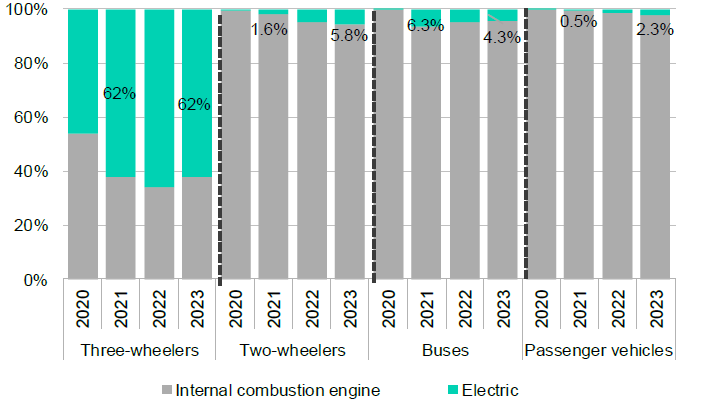

- Passenger EV sales gain ground off the back of more affordable models: India’s annual

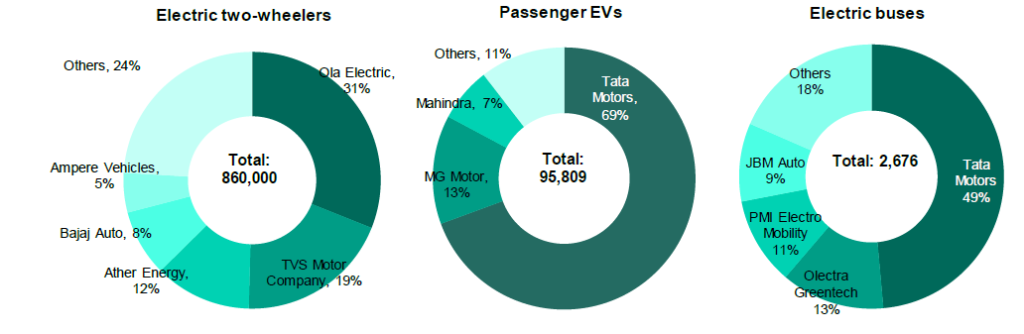

passenger EV sales, which include cars and multi-utility vehicles, nearly doubled to 96,000 in - EVs now account for 2.3% of all passenger vehicle sales. Private demand for EVs in this segment remained strong, fueled by the popularity of compact electric SUVs, as well as the launch of low-cost models in the small segment such as Tata Motors’ Tiago EV and MG Motor’s Comet EV. Demand from shared mobility operators has held steady, driven by startups operating all-electric fleets and Uber’s target of inducting 25,000 EVs.

- Electric two-wheeler sales held strong despite reduced subsidies: Annual two-wheeler sales in India grew by 13% in 2023 to nearly 18 million, BloombergNEF estimates. EVs were just under 6% of these sales, at over 1 million units. Electric models in the segment benefit from increasing gasoline prices, numerous launches, and favorable total ownership costs over gasoline two-wheelers.

Figure 1: Share of EVs in India’s new vehicle sales, by segment

Society of Manufacturers of Electric Vehicles, JATO Dynamics, BloombergNEF. Note: Includes

sales estimates for electric two- and three-wheelers with top speeds of less than 25 kilometers

per hour. Two-wheeler, three-wheeler and bus sales include estimates for Telangana.

- Delhi and Maharashtra lead in electric bus deployments: Electric bus demand continues to rely on government procurement. In 2023, Delhi led the market with 1,121 e-buses added. This was nearly three times the additions in the state a year ago and accounted for 42% of all e-buses deployed. Moreover, this was followed by Maharashtra with 451 e-buses. The push from state governments remains the largest driver of EV adoption in this segment, supported by federal subsidies.

- Maharashtra leads EV deployment across most vehicle segments: Among all Indian states, Maharashtra had the largest fleet of electric two-wheelers, passenger EVs and ebuses by the end of 2023. Karnataka followed, with the second-largest fleet of electric twowheelers and cars. As of 2023, Delhi’s municipal bus fleet electrification ranked second nationwide, closely following Maharashtra’s significant e-bus deployment.

- Charging infrastructure: India had nearly 17,000 public EV charging stations by March 2024. Assuming each station has two chargers, on average, a public charger can support eight electric cars. This number is likely higher because most of India’s public EV chargers that were installed prior to 2022 were based on the Bharat charging standards. Moreover, None of the passenger EVs available today are compatible with these chargers.

- Policy support continues to grow: Federal and state governments have announced several policies and regulations to boost EV adoption in India. These include demand-side subsidies for EV and charging equipment purchases, as well as supply-side support to incentivize local manufacturing. Delhi became the first state in India to mandate phase-out targets for fossilfuel vehicles in selected vehicle segments. More federal support for charging infrastructure is planned, with the details expected to be announced in July. E-buses could also see a boost amid the federal government’s announced payment security mechanism in partnership with the US.

Figure 2: Indian manufacturers’ shares of electric vehicle sales in 2023, by segment

data unavailability. Two-wheeler sales do not include low-speed vehicles. Data as of January 18, 2024.