Hydrogen fuel cell vehicle market surge : from USD 1.5 billion in 2022 to USD 57.9 billion by 2032 | CAGR of 43%

Hydrogen fuel cell vehicle market surge : from USD 1.5 billion in 2022 to USD 57.9 billion by 2032 | CAGR of 43%

Press Release, 7 November, 2024

According to a new report published by Allied Market Research, titled, “Hydrogen Fuel Cell Vehicle Market,” The hydrogen fuel cell vehicle market was valued at $1.5 billion in 2022, and is estimated to reach $57.9 billion by 2032, growing at a CAGR of 43% from 2023 to 2032.

The hydrogen fuel cell vehicle industry holds great potential in the near future to change the scenario of global environment concerns regarding pollutions and carbon emissions. Though developing hydrogen fuel cell vehicles in countries and adoption of HFCV globally support the market growth during the forecast timeframe. Nations are rapidly changing the policies regarding the subsidies for hydrogen fuel cell vehicles for achieve the net zero carbon emission target. Also, the other local government activities on climate may increase the opportunity for fuel cell electric buses in the U.S. Furthermore, the newly formed Fuel Cell Electric Bus Commercialization Consortium is also promoting deployments, supported by the California Air Resources Board. Such establishments will give notable growth to the hydrogen fuel cell vehicle market.

For instance, Hyundai Auto Canada Corp has announced the arrival of fuel cell SUV named “NEXO” in March 2019. The NEXO is powered with the hydrogen and has a range of 570 km. In addition, by collaborating with Vancouver based carsharing service -Modo, this NEXO will be available for customer use. Furthermore, in April 2019, Ballard Unmanned Systems (subsidiary of Ballard Power Systems, Inc.) announced the launch of the FCair fuel cell product line for commercial UAVs.

By vehicle type, the market is categorized into sedan, SUV, and other (hatchback, commercial vehicles, and others). The SUV segment gained the highest market share in 2021 and is projected to lead the market within the forecast timeframe due to the rapid adoption of SUV’s in developing countries. In addition, the increasing innovations, and developments by market players which in turn to drive the demand for HFCV’s in the forecast timeframe. For instance, in December 2020, Toyota Motor Corporation (Toyota) launched the completely redesigned “Mirai” fuel cell electric vehicle (FCEV). FCEVs run on hydrogen, a fuel that can be produced from various energy sources and contributes to preservation of the global environment and reinforcing energy security. The new Mirai will serve as a new departure point for creating a hydrogen-based society of the future.

By technology, the hydrogen fuel cell vehicle market size is categorized as proton exchange membrane fuel cell, and phosphoric acid fuel cell. Among these segments proton exchange membrane fuel cell segment captured the significant market share as compared to other segments owing to the higher use of this technology for better fuel efficiency. By range, the market is categorized as 0-250 miles, 251-500 miles, and above 500 miles. The 251-500 miles segment dominated in the global market due to the rising number of vehicles produced in this category which increases the demand for 251-500 miles vehicles. The market players are expanding the capabilities of the development which improves the production capacity and support the market expansion globally during the forecast period. For instance, in January 2021, Toyota Motor Corp. and its group companies stepped up efforts to develop auto parts for hydrogen fuel-cell vehicles and expand their market amid a global shift to eco-friendly cars that do not emit carbon dioxide.

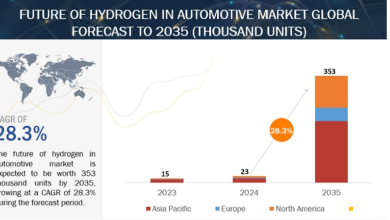

The Asia Pacific region will have a higher market share across the globe due to the highest population with presence of many giant market players in this market which support the growth of the Asia-Pacific region and expected to growth with the substantial growth rate during the forecast period. Increase in government initiatives to augment hydrogen fuel cell infrastructure drives hydrogen fuel vehicle market in this region. Further, domestic presence of hydrogen fuel cell vehicle (HFCV) OEMs in this region and rise in environmental concern fuels the market growth. According to the South Korean government, transition to a hydrogen economy will create roughly 420,000 new jobs and bring in $38.2 billion by 2040.

Moreover, the U.S. cities are looking forward to eliminating the emissions from their public transit fleets. For instance, the mayor of Los Angeles has set an objective of 2030 for an emissions-free fleet. Also, the companies are expanding the U.S. market for increasing their revenue which increases the market share of the U.S. during the forecast period. For instance, Hyundai Motor planned to expand into U.S. Market with Hydrogen-powered XCIENT Fuel Cells at ACT Expo. At the ACT Expo, the largest advanced transportation technology and clean fleet event, Hyundai Motor will share the progress of the NorCAL ZERO Project. Through the project, also known as Zero-Emission Regional Truck Operations with Fuel Cell Electric Truck, Hyundai Motor will deploy 30 Class 8 6×4 XCIENT Fuel Cell heavy-duty tractors at the Port of Oakland, California, in 2023.

𝐊𝐞𝐲 𝐅𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐎𝐟 𝐓𝐡𝐞 𝐒𝐭𝐮𝐝𝐲 :

By vehicle type, the SUV segment dominated the global Hydrogen Fuel Cell Vehicle market in terms of growth rate.

By technology, the proton exchange membrane fuel cell segment dominated the global Hydrogen Fuel Cell Vehicle market in terms of growth rate.

By range, the 0-250 miles segment dominated the global Hydrogen Fuel Cell Vehicle market in terms of growth rate.