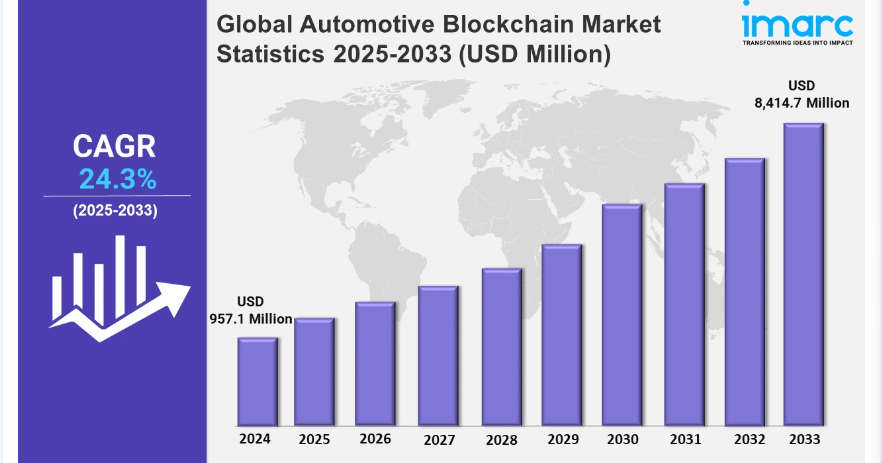

Global automotive blockchain market expected to reach USD 8,414.7 million by 2033 – IMARC Group

Global Automotive Blockchain Market Statistics, Outlook and Regional Analysis 2025-2033

Press Release, 13 November 2024

The global automotive blockchain market size was valued at USD 957.1 Million in 2024, and it is expected to reach USD 8,414.7 Million by 2033, exhibiting a growth rate (CAGR) of 24.3% from 2025 to 2033.

The industry is being driven by rising concerns about the security of sensitive information. Furthermore, as contemporary automobiles become more autonomous and linked, protecting vehicle performance data and personal information becomes increasingly important. Automotive blockchain technology strives to increase customer and stakeholder trust, hence driving market growth.

Moreover, smart contracts are gaining momentum because they provide automatic and self-executing agreements that increase operational efficiency. Furthermore, they simplify operations, such as insurance claims, vehicle leasing, and parts procurement. Smart contracts reduce administrative expenses and errors by removing the need for intermediary firms and manual monitoring, hence increasing demand for the automotive blockchain. For instance, in February 2024, the city of Shenzhen collaborated with the Agricultural Bank of China to implement digital yuan smart contracts for car pre-payments. This initiative allows consumers to use the digital yuan (e-CNY) for vehicle deposits, with funds released upon delivery, enhancing transaction security and efficiency. Furthermore, North American automotive blockchain suppliers are working on improving supply chain transparency and transaction efficiency. Companies, such as Ford and General Motors, are using blockchain to improve procedures involving parts traceability and vehicle history tracking. Additionally, the burgeoning automotive aftermarket and replacement industries provide considerable income prospects as customers seek more reliable and verified automobile data. High-performance blockchain solutions are preferred over traditional data management systems because they are secure and tamper-proof. For example, the surge in demand for blockchain-based solutions is obvious in the U.S., where major automakers and parts suppliers work with digital companies to incorporate this technology, assuring compliance and confidence in vehicle transactions.

Global Automotive Blockchain Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest automotive blockchain market share, on account of the elevating regulatory support from government agencies.

North America Automotive Blockchain Market Trends:

North America exhibits a clear dominance in the market, owing to the growing demand for improved automotive software. Advanced software solutions simplify operations, enhance vehicle performance, promote supply chain transparency, and encourage innovative services. For example, in May 2024, DeLorean collaborated with Otherlife to create a marketplace that allows automakers to sell, buy, and trade vehicle reservation slots by leveraging automotive blockchain technology.

Europe Automotive Blockchain Market Trends:

In Europe, the focus on data security in connected automobiles is driving blockchain adoption. Volkswagen investigated blockchain to improve data security and autonomous driving systems, hence facilitating compliance with complex European data protection requirements.

Asia Pacific Automotive Blockchain Market Trends:

Automotive blockchain usage in the Asia Pacific is increasing for supply chain transparency, as demonstrated by Toyota’s integration of blockchain to track components procurement and delivery. This enhances traceability and confidence between manufacturers and suppliers in countries, such as Japan and South Korea.

Latin America Automotive Blockchain Market Trends:

Brazil’s automobile sector is using blockchain to avoid counterfeiting. Companies are adopting blockchain to authenticate replacement parts, assuring quality and safety, especially in a market where counterfeit components are a problem. This approach promotes openness and dependability in Latin America’s automobile industry.

Middle East and Africa Automotive Blockchain Market Trends:

The UAE automotive businesses are using blockchain for smart contract applications in automobile sales and leasing. This trend facilitates transactions and boosts confidence, therefore boosting the Middle East and Africa region’s transition to digital transformation and transparent corporate practices.

Top Companies Leading in the Automotive Blockchain Industry

Some of the leading automotive blockchain market companies include Accenture plc, BigchainDB GmbH, carVertical, ConsenSys, GemOS, HCL Technologies Limited (HCL Enterprise), International Business Machines Corporation, Microsoft Corporation, NXM Labs Inc., ShiftMobility Inc., and Tech Mahindra Limited, among many others. For example, ShiftMobility Inc. launched a blockchain-powered platform for the automotive industry to connect and manage vehicle and supply chain apps, commerce channels, diagnostics, and logistics, supporting current needs and future autonomous developments.

Global Automotive Blockchain Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into public blockchain, private blockchain, and hybrid blockchain. Public blockchain, such as Ethereum and Bitcoin, is decentralized and accessible to anybody. A private blockchain, on the other hand, is limited and controlled by a single company, providing more security. Furthermore, a hybrid blockchain is ideal for applications that require both public verification and private cooperation.

- Based on the provider, the market is categorized into application and solution, middleware, and infrastructure and protocol, amongst which application and solution dominate the market. The inflating need for improved efficiency, transparency, and security in the automobile sector is driving the segment’s growth.

- On the basis of the mobility type, the market has been divided into personal mobility, shared mobility, and commercial mobility. Blockchain for personal mobility offers maintenance histories, secures vehicle registration records, and allows for smooth peer-to-peer transactions, among other things. Furthermore, the growing number of shared mobility services increases the necessity for automotive blockchain technology. Its use in commercial mobility is to optimize fleet management.

- Based on the application, the market is bifurcated into financing, mobility solutions, smart contract, and supply chain, wherein supply chain dominates the market. The escalating emphasis on providing a transparent ledger that records every transaction and movement of parts across the supply chain is contributing to the segment’s expansion.

- On the basis of the end user, the market is segmented into OEMs, vehicle owners, mobility as a service provider, and others. The technology guarantees that OEMs can manage their supply chains efficiently. Aside from that, vehicle owners benefit from blockchain since it provides immutable records of ownership. Mobility as a service provider, including ride-sharing and car-sharing firms, must provide transparent ride monitoring. This has a beneficial impact on the automotive blockchain market prospects in the category.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 957.1 Million |

| Market Forecast in 2033 | USD 8,414.7 Million |

| Market Growth Rate (2025-2033) | 24.3% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:TypeProviderMobility TypeApplicationEnd UserRegion |

| Types Covered | Public Blockchain, Private Blockchain, Hybrid Blockchain |

| Providers Covered | Application and Solution, Middleware, Infrastructure and Protocol |

| Mobility Types Covered | Personal Mobility, Shared Mobility, Commercial Mobility |

| Applications Covered | Financing, Mobility Solutions, Smart Contract, Supply Chain |

| End Users Covered | OEMs, Vehicle Owners, Mobility as a Service Provider, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, BigchainDB GmbH, carVertical, ConsenSys, GemOS, HCL Technologies Limited (HCL Enterprise), International Business Machines Corporation, Microsoft Corporation, NXM Labs Inc., ShiftMobility Inc., Tech Mahindra Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |