Global auto semiconductor market to hit $95B by 2030

New York, Nov. 21, 2023 (GLOBE NEWSWIRE) — A new market research report from Persistence Market Research analyzes the automotive semiconductor market, providing insights into market trends, drivers, and key players. The automotive semiconductor market is a large and rapidly growing industry that is expected to reach a value of USD 95.0 billion by 2030. This growth is being driven by a number of factors. These factors include the increasing demand for electric vehicles (EVs), the growing popularity of advanced driver-assistance systems (ADAS), and the increasing complexity of automotive systems.

Market Overview

The automotive semiconductor market plays a pivotal role in the digital transformation of the automotive industry. Semiconductors are essential components that power various electronic systems in vehicles. These systems include engine control units, infotainment systems, and advanced driver-assistance systems (ADAS). With the relentless advancement of automotive technology, including electrification, autonomous driving, and connectivity, the demand for sophisticated and interconnected semiconductors has never been higher.

One of the primary drivers of the automotive semiconductor market’s growth is the rapid shift towards electric vehicles (EVs). The world is addressing environmental concerns and the need to reduce carbon emissions. Manufacturers are increasingly adopting electrified powertrains, driving the demand for specialized semiconductor components tailored to EVs.

Moreover, autonomous vehicles are reshaping the automotive landscape. The pursuit of greater vehicle autonomy, driven by the potential for improved safety and efficiency, has led to a growing demand for semiconductor components. These components enable cutting-edge technologies, sensors, and computing capacity. Lidar sensors, radar systems, and advanced cameras require high-performance semiconductor solutions for data processing and analysis. This demand is propelling the growth of the semiconductor industry.

Market Snapshot:

| Report Coverage | Details | |

| Market Revenue 2023 | US$ 57.3 Billion | |

| Estimated Revenue 2030 | US$ 95.0 Billion | |

| Growth Rate – CAGR | 7.5% | |

| Forecast Period | 2023-2030 | |

| No. of Pages | 238 Pages | |

| Market Segmentation | By Component, Vehicle Type, Application, Region | |

| Regions Covered | North America, Latin America, Europe, South Asia & Pacific, East Asia, The Middle East & Africa | |

Key Trends Shaping the Automotive Semiconductor Market

- Increasing Demand for Electric and Hybrid Vehicles: Electric vehicles (EVs) and hybrid electric vehicles (HEVs) are becoming increasingly popular. Consumers are becoming more concerned about the environment. These vehicles require more semiconductors than traditional gasoline-powered vehicles, as they have a number of complex electronic systems.

- Growing Complexity of Modern Vehicles: Modern vehicles are becoming increasingly complex, with a growing number of electronic systems. This is driving the demand for more sophisticated semiconductors that can handle these complex systems.

- Increasing Adoption of Advanced Driver-Assistance Systems (ADAS): ADAS are becoming increasingly popular as they can help to improve safety and reduce accidents. These systems require a number of semiconductors, such as sensors and processors.

- Autonomous Driving: Autonomous driving is the next frontier in automotive technology. It expected to have a major impact on the automotive semiconductor market. Autonomous vehicles will require even more semiconductors than ADAS features. They will need to process data from a wider range of sensors and make complex decisions in real time. The development of autonomous driving systems is still in its early stages. However, it expected to drive demand for automotive semiconductors.

- Connectivity: Connected cars are vehicles that are equipped with internet connectivity. This allows them to connect to the internet and other vehicles, providing a range of new features and services. Examples include real-time traffic updates, remote diagnostics, and in-car entertainment. The growing popularity of connected cars expected to drive demand for automotive semiconductors. This projection indicates a growth rate of 10.4% from 2022 to 2032.

- Silicon Carbide (SiC) and Gallium Nitride (GaN): SiC and GaN are semiconductors that are more efficient than traditional silicon semiconductors. They are well-suited for use in automotive applications. They can help improve the fuel efficiency of EVs and reduce the power consumption of ADAS features. The increasing adoption of SiC and GaN semiconductors expected to drive demand for automotive semiconductors.

The automotive semiconductor market is segmented by component, vehicle type, application, and region.

Component: Further segment the component segment into processors, analog ICs, discrete power devices, sensors, memory devices, and lighting devices.

The largest market share is expected to be held by processors. Their increasing applications in advanced driver-assistance systems (ADAS), connectivity, and autonomous driving drive this. Sensors, such as lidar, radar, and cameras, are witnessing rapid growth due to the rise of autonomous vehicles and ADAS

Vehicle Type: Further segment the vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Anticipate passenger cars to dominate the market, considering their substantial global clientele and demand for individual transportation. The expansion of e-commerce and urbanization expected to drive rapid growth in light commercial vehicles (LCVs).

Application: Further segment the application into safety, powertrain, body electronics, telematics and infotainment, and chassis.

The powertrain segment, which includes engine and transmission systems, is projected to capture the largest market share. Meanwhile, the telematics and infotainment sector is set to experience rapid growth. This growth is driven by consumer demand for connected vehicles and advanced infotainment systems.

In a nutshell, the Persistence Market Research report is a must-read for start-ups, industry players, investors, researchers, consultants, business strategists. Moreover, it is essential for all those who are looking to understand this industry.

Regional Insights

The automotive semiconductor market is a global industry with a presence in every major region. However, a few key regions, namely Asia Pacific, North America, and Europe, dominate the market.

Asia Pacific: The Asia Pacific region is the largest market for automotive semiconductors, accounting for over 45% of the global market share in 2022. This is due to the strong growth of the automotive industry in the region, particularly in China, Japan, and South Korea. China is the largest automotive semiconductor market in the world, and it expected to continue to grow at a rapid pace in the coming years. The increasing demand for EVs and ADAS features in China drives this growth.

North America: The North American automotive semiconductor market is the second largest in the world, accounting for around 30% of the global market share in 2022. The United States is the largest automotive semiconductor market in North America, and it is home to a number of leading semiconductor manufacturers, including Qualcomm, NXP, and Texas Instruments. The North American automotive semiconductor market expected to grow at a CAGR of 8.4% from 2022 to 2032. The increasing demand for EVs and ADAS features in North America drives this growth.

Europe: The European automotive semiconductor market is the third largest in the world, accounting for around 20% of the global market share in 2022. Europe is home to a number of leading automotive semiconductor manufacturers, including Infineon Technologies, STMicroelectronics, and Bosch. The European automotive semiconductor market expected to experience a 7.8% compound annual growth rate (CAGR) from 2022 to 2032. The increasing demand for EVs and ADAS features in Europe is driving this growth.

Other Regions: The automotive semiconductor market is also growing in other regions, such as Latin America, the Middle East, and Africa. The increasing demand for EVs and ADAS features expected to drive strong growth in these regions in the coming years.

Competitive Intelligence and Business Strategy

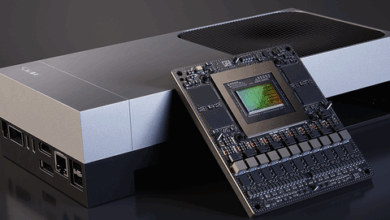

Leading companies in automotive semiconductors, including Intel Corporation, Qualcomm Technologies, Inc., and NVIDIA Corporation, are focusing on constant innovation to maintain and increase their market share. Intel, for instance, is investing heavily in autonomous driving and AI technologies. Qualcomm strategically positions itself in the connectivity industry, aiming to facilitate uninterrupted communication in connected vehicles through 5G technologies.

These industry leaders are also addressing specific challenges such as disruptions in the supply chain and the need for enhanced cybersecurity measures. Their strategic approach involves not only solving current industry demands but also predicting and resolving future obstacles, demonstrating a commitment to long-term sustainability and relevance in the rapidly changing automotive sector.

Key developments in the automotive semiconductor market

The automotive semiconductor market is rapidly evolving, driven by the increasing demand for advanced technologies such as autonomous driving, electric vehicles, and connected cars. Here are some of the latest developments in the market:

Increasing adoption of SiC and GaN semiconductors: Silicon carbide (SiC) and gallium nitride (GaN) are wide-bandgap semiconductors that offer several advantages over traditional silicon semiconductors, including higher efficiency, lower power consumption, and better thermal performance. This makes them ideal for use in automotive applications such as electric vehicle powertrains and inverters.

Development of new sensors for autonomous vehicles: Autonomous vehicles require a variety of sensors to operate safely and effectively, including lidar, radar, and cameras. Lidar sensors are particularly important for autonomous vehicles, as they can provide a 3D image of the surroundings. In recent years, there has been significant development in lidar technology, with new sensors that are more compact, affordable, and accurate.

Growing demand for semiconductors for in-vehicle infotainment systems: In-vehicle infotainment (IVI) systems are becoming increasingly sophisticated, with features such as touchscreen displays, voice recognition, and navigation. This is driving demand for semiconductors that can support these features.

Increasing focus on cybersecurity: The automotive industry is becoming increasingly aware of the cybersecurity risks associated with connected cars. As a result, there is a growing demand for semiconductors that can help to protect connected cars from cyberattacks.

Consolidation in the semiconductor industry: The semiconductor industry is consolidating, with a number of large companies acquiring smaller companies. This is driven by the need for economies of scale and the need to develop new technologies.

Investment in new semiconductor manufacturing plants: There is a significant investment in new semiconductor manufacturing plants around the world. This is driven by the increasing demand for semiconductors, as well as the need to reduce reliance on foreign suppliers.

Development of new semiconductor packaging technologies: There is a growing trend towards the use of new semiconductor packaging technologies, such as chip-on-wafer (CoW) and fan-out wafer-level packaging (FO-WLP). These technologies offer several advantages over traditional packaging methods, including smaller size, lower cost, and better performance.

Increasing adoption of artificial intelligence (AI) in automotive semiconductors: AI is being used in a variety of automotive applications, such as autonomous driving, advanced driver-assistance systems (ADAS), and predictive maintenance. This is driving demand for semiconductors that can support AI applications.

Development of new standards for automotive semiconductors: There are a number of new standards being developed for automotive semiconductors, such as AUTOSAR and OPEN Alliance Automotive (OAA). Moreover, these standards are designed to help to improve the safety, reliability, and interoperability of automotive semiconductors.

Market Challenges and Opportunities

The automotive semiconductor market expected to grow significantly in the coming years, driven by increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles (AVs). However, there are a number of challenges that new entrants to this market will need to overcome.

Challenges:

- High capital investment: The cost of developing and manufacturing automotive semiconductors is very high. This is due to the need for specialized equipment and facilities, as well as the long lead times involved in bringing new products to market.

- Long product development cycles: The development cycle for automotive semiconductors can be up to 10 years. This is due to the need for extensive testing and validation to ensure that the chips meet the high reliability and safety standards required for automotive applications.

- High competition: The automotive semiconductor market is highly competitive, with a number of established players. New entrants will need to differentiate themselves in order to succeed.

- Rapid technological change: The automotive semiconductor industry is constantly evolving, with new technologies emerging all the time. New entrants will need to be able to keep up with the latest trends in order to remain competitive.

- Complex supply chain: The automotive semiconductor supply chain is complex and global. New entrants will need to develop strong relationships with suppliers in order to secure the chips they need.

- Regulatory requirements: The automotive semiconductor industry is subject to a number of regulatory requirements. New entrants will need to ensure that their products comply with all applicable regulations.

Opportunities

- Growing demand for ADAS and AVs: The demand for ADAS and AVs expected to grow significantly in the coming years. This will create a large market opportunity for automotive semiconductors.

- Increasing complexity of vehicles: Modern vehicles are becoming increasingly complex, with more and more electronic systems. This is creating a demand for more sophisticated automotive semiconductors.

- Shift to electric vehicles (EVs): The shift to EVs is creating a demand for new types of automotive semiconductors, such as power semiconductors.

- Emerging markets: Emerging markets are a major growth opportunity for the automotive semiconductor market. These markets are experiencing rapid growth in vehicle production.

Here are some additional tips for new entrants to the automotive semiconductor market:

- Focus on a niche market: The automotive semiconductor market is very large and diverse. New entrants should focus on a niche market where they can develop a competitive advantage.

- Develop strong relationships with key customers: New entrants should develop strong relationships with key customers in the automotive industry. This will help them to gain market share and grow their business.

- Invest in research and development: The automotive semiconductor industry is constantly evolving, so it is important for new entrants to invest in research and development. This will help them to develop innovative products that meet the needs of the market.

- Be patient: The automotive semiconductor industry is a long-term investment. New entrants should be patient and prepared to stay committed to the market for the long haul.

Overall, the automotive semiconductor market is a challenging but promising market for new entrants. New entrants will need to overcome a number of challenges, but the opportunities are significant. The market is growing, new technologies are emerging, and customer demands are changing. New entrants who can successfully navigate these challenges will position themselves well for long-term success.

The Automotive Semiconductor Market Research report provides comprehensive information on the current state of the market, key trends and drivers, and future growth prospects. The report also provides detailed analysis of the competitive landscape, including market share, product portfolio, and business strategies of key players.