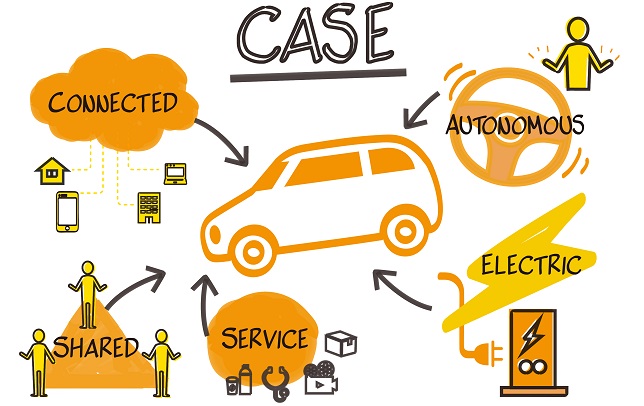

Auto OEMs + Tech Startups = Connected, Autonomous, Shared Electric Ecosystems (CASE)

For shaping up the Autonomous Ecosystem, yesterday’s self-contained Automotive OEMs & Tier 1 suppliers are coming together & grabbing the opportunity in partnering, investing, acquisitions & more than anything accepting Technology primarily in the following space:

- Ride Sharing & P2P Car Rental Platforms

- Advanced Driver Assistance Systems (ADAS)

- Machine Learning / Artificial Intelligence

- Mapping & Localization Technology

- Connected Car (Telematics, Infotainment)

- Cyber Security

- Electric Vehicles & Charging Infra

OEMs’ R&D Center moving from Michigan to California, Money flowing from China to US

Mobility Models (Ride Sharing & P2P Car Rental Platforms):

| OEMs & Corporate Venture Capital / VC | Rideshare / P2P Car Rental |

| Ford (Fontinalis Partners) | Cargo, Zoomcar, Turo, Zagster ($), Chariot (+) |

| General Motors (GM Ventures) | Lyft, Yi Wei Xing ($), Maven, Sidecar (+) |

| Fiat Chrysler Group, PSA Group (Stellantis) | KooliCar ($) |

| Volvo (Geely, Volvo Ventures) | Uber, RidePal, CaoCao($), Luxe (+) |

| Volkswagen | Gett ($), Quicar, Europcar (+) |

| Daimler (Daimler Mobility Services) | Moovel [Car2Go, Ridescout, Hailo, BlackLane, Turo(+), Careem ($))] |

| BMW (BMW I Ventures) | ReachNow (+), Scoop Tech, May Mobility, Fair, Turo ($) |

| Daimler | Intelligent Apps (+), Via, Blacklane, Turo ($) |

| Audi (Audi Electronics Ventures) | SilverCar (+) |

| Tesla Motors | Tesla Share (Tesloop) |

| SAIC Motor (SAIC Capital) | GetAround, YourMechanic ($) |

| Honda (Honda Xcelerator) | Grab ($) |

| Toyota ( Mirai Creation Investment, TRI) | DiDi, Uber, Getaround, Grab, May Mobility, JapanTaxi ($) |

| Hyundai / Kia Motors (Hyundai Ventures) | Ola, Grab, Revv, LUXI ($) |

| Renault-Nissan-Mitsubishi | Marcel, Klaxit |

| Mercedes Benz | FlightCar (+), Via |

| NIO Motors (NIO Capital) | Dida, Shouqi Limousine & Chauffeur($) |

OEMs are following Unicorns like Uber, Lyft to adopt & strategise to various transport-mobility innovations which may be in the form of pay-per-use models such as car sharing, carpooling and peer-to-peer car rentals. OEMs have been investing, acquiring or launching their own ride sharing venture. For example: General Motors recently invested in Lyft, acquired SideCar & jointly started his own ride-sharing venture Maven. GM even invested in ride share tech platform provider of China: Yi Wei Xing, where the OEM is simultaneously also experimenting the evolving nature of ride sharing models in different markets & creating ways for expanding its services in the big markets.

Advanced Driver Assistance Systems (ADAS):

The broad penetration of Autonomous Vehicles is not only accelerating the development of various new technologies like advanced & multiple sensor communication & fusion, GPS Positioning, Image Recognition and Computer Vision but also bolstering the development of Robotics and drones. Both could get benefit from using the same infrastructure including recharging stations, service centers & M2M communication networks. A standard technical architecture for making transportation autonomous, lies on the following stages of development:

- Multiple Sensors Technology (Camera, Radar & Lidar)- for taking visual pictures of infrastructure & traffic conditions.

- Sensor Fusion- where different sensors inputs are synthesized into the software algorithm for detection of vehicle moving towards/away/alongside you.

- Autonomous Engine (AI & Robotics)- which automates the vehicle functions like steering, accelerating & braking in real time within a splash of a second.

OEMs invest & acquire in the space primarily for developing right technological expertise & ventures which integrate the hardware and software systems.

| OEMs | ADAS (Sensors / Camera / LiDAR / Radar) |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Velodyne Lidar, Ouster ($) |

| General Motors (GM Ventures) | Aeye, Oculi ($) |

| Fiat Chrysler Group, PSA Group (Stellantis) | Waymo (~), Magneti Marelli ($) |

| Volvo (Geely, Volvo Ventures, Volvo Cars Tech Fund) | Luminar, Fortellix ($), Autoliv, Zenuity (~) |

| Volkswagen | TuSimple ($) |

| Audi (Audi Electronics Venture) | e.solutions (+) |

| BMW (BMW I Ventures) | Nauto, Autobrains, Lunewave, Blackmore Sensors($) |

| Daimler (Daimler Trucks NA) | Quanergy Systems, Luminar ($) |

| Caterpillar (Caterpillar Ventures) | TriLumina ($) |

| SAIC Motor (SAIC Capital) | Robosense ($) |

| Honda (Honda Xcelerator, Honda Strategic Venturing) | GM’S Cruise ($) |

| Toyota ( Mirai Creation Investment) | Autobrains, Nauto ($) |

| Hyundai / Kia Motors / Mobis (Hyundai Ventures) | Velodyne, StradVision, Metawave($), Uiwang(~) |

| Renault-Nissan-Mitsubishi | Prophesee, Mobileye, Chronocam ($) |

| Nio Motors (NIO Capital) | Innovusion ($) |

For Example: Ford along with Baidu jointly invested in Velodyne LiDAR (subsidiary of Velodyne Acoustic which manufactures audio equipment, subwoofer products). Velodyne brought down the cost of LiDAR system from $80,000 to $500 and visions to bring it to $100, which can produce 300K-1.2M data points per second, which are interpreted by the system’s algorithms to create high-resolution 3D images. These images can be used for mapping {by Civil Maps (Ford’s Investment)} to help a car understand the surroundings & avoid collision detection. Ford & Baidu earlier partnered for offering infotainment services in China in 2013. Baidu (Google of China), is setting up an R&D center in Silicon Valley, plans to develop autonomous car software whose OS for driverless car called Baidu AutoBrain integrates Baidu’s MyCar car-connectivity, CarLife synchronization software for mobile devices & Maps. Changan Auto’s cars which use Baidu’s 3D Maps has a joint venture with Ford.

The joint investment venture of Ford as an OEM & Baidu as a tech venture is not just going to help the Ford’s Driverless Car plans but the complete automotive OEM & Tier-1, 2 supplier’s ecosystem for developing cost effective autonomous cars.

Vehicle Engineering taking a transition from Mechanical to Electronics to Software

Artificial Intelligence:

Deep Learning & AI will play a key role in mimicking the human neural networks, will enable the road to fully autonomous vehicles since they allow detection & recognition of multiple objects, improve perception, reduce power consumption, support object classification, enable recognition & prediction of actions, which will naturally reduce development time of ADAS systems. AI based systems are also going to play important role in Manufacturing Production Lines & Crash Testings by reducing significant time & cost in the process.

| OEMs | AI |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Argo, Phantom, Invision ($), Quantum Signal, Nutonomy, SAIPS (+) |

| General Motors (GM Ventures) | Algolux, Helm AI, Momenta, Nauto ($), Cruise (+), VocalIQ |

| Fiat Chrysler Group, PSA Group (Stellantis) | Waymo (~) |

| Volvo (Geely, Volvo Ventures) | Lytx ($) |

| Tesla Motors | DeepScale(+) |

| Volkswagen, Porsche | Argo AI ($), DFKI, Inrix (~) |

| Audi (Audi Electronics Venture) | TTTech (+), Cubic Telecom ($), Mobileye (~) |

| BMW (BMW I Ventures) | Kodiak Robotics, Plus One Robotics, Recogni, Zendrive($), Nauto |

| Daimler | Momenta, Blaize,($), Torc Robotics (+) |

| Caterpillar (Caterpillar Ventures) | OTTO Motors ($) |

| SAIC Motor (SAIC Capital) | Momenta, Plus, Black Sesame, TRON ($) |

| Honda (Honda Xcelerator) | Cruise ($) |

| Toyota ( Mirai Creation Investment) | Momenta, Pony.AI, Preferred Networks ($) |

| Hyundai / Kia Motors / Hyundai Mobis (Hyundai Ventures) | Aurora, MORAI, Allegro, Deep Glint, Perceptive Automata, IonQ($) |

| Renault-Nissan-Mitsubishi | WeRide ($), Ejenta |

| Mercedes Benz | Momenta ($) |

| NIO Capital | Momenta, Trunktech, Black Sesame($) |

For Example: Bill Ford’s VC arm (Fontinalis Partners) invested in nuTonomy (MIT spinoff), autonomous vehicle software startup to develop self-driving taxi service in Singapore for testing its platform in Mitsubishi iMiev, Renault Zoe Vehicles.

Mapping and Localization:

| OEMs | Map |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Civil Maps, Humatics ($), TransLoc (+), Baidu (~) |

| Fiat Chrysler Group, PSA Group (Stellantis) | Navteq, TomTom (~) |

| Volvo (Geely, Volvo Ventures) | deCarta (+ by Uber), HERE (~) |

| Volkswagen | Google Maps |

| Audi (Audi Electronics Venture) | HERE (+), DutchMap, TomTom (~) |

| BMW (BMW I Ventures) | HERE (+) |

| Daimler | what3words ($), HERE (+) |

| SAIC Motor (SAIC Capital) | what3words, Savari ($) |

| Honda (Honda Xcelerator) | Dynamic Map Platform ($) |

| Toyota ( Mirai Creation Investment) | Dynamic Map Platform, Zenrin($) |

| Renault-Nissan-Mitsubishi | Microsoft (~), Dynamic Map Platform ($) |

Two major players specialize in digital worldwide Map database creation: HERE & TomTom. HERE (acquired by coalition of Audi, BMW & Daimler), named George Vehicles using high precision GPS, motion tracking inertial system, laser scanners and 4 cameras develops HD Maps; while TomTom captures Depth Maps using LiDAR. Both HERE & TomTom develop low-level aerial information which could be used by Drone makers for navigation because of which even Drone Delivery ventures would be interested to partner with Mapping companies.

Connected Car (Telematics, Infotainment):

| OEM | Connected Car (Telematics / IVI ) |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Motorq, FreshCar, Pivotal ($), Livio Connect (+) |

| General Motors (GM Ventures) | Wejo, Telogis ($), Onstar |

| Fiat Chrysler Group, PSA Group (Stellantis) | Uconnect, QNX, Masternaut |

| Volvo (Geely, Volvo Ventures) | Forciot ($), Wireless Car (+) |

| Volkswagen, Porsche | WirelessCar (+), SeeReal, Mobvoi ($), ZYNC ($) |

| BMW (BMW I Ventures) | Ridecell, Parkmobile ($) |

| Daimler | Hap2u, Zonar Systems, Platform Science($) |

| SAIC Motor (SAIC Capital) | KOTEI (+), Banma, Sonatus, iSMARTWAYS, CalmCar($) |

| Toyota ( Mirai Creation Investment) | KDDI (~), Soracom($) |

| Hyundai / Kia Motors (Hyundai Ventures) | Kardome, SoundHound, Autotalks, Envisics, 42dot, Ottopia($) |

| Renault-Nissan-Mitsubishi | Gestigon (~), Sylpheo (+) |

| NIO Capital | Autolink ($) |

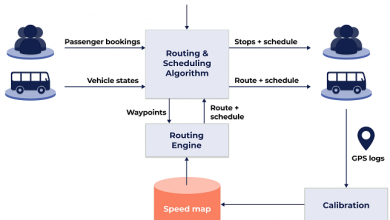

To complement autonomous transportation ecosystem, Telematics will play a key role in monitoring and managing a fleet of autonomous pods through collation & analysis of data, & also in tracking any kind of malfunctioning of the pods through software & hardware analysis. Telematics Service provider may devise a Pay-per-use and premium subscription model which can be sold on contractual basis for maintenance, diagnostics, infotainment and content streaming for autonomous transportation.

For Example: BestMile, a Swiss based startup is providing a cloud-based fleet management platform designed to connect, operate & optimize any fleet of autonomous vehicles. It has recently launched “SmartShuttle” in Switzerland, in partnership with PostBus, the largest provider of public bus transportation. It has even partnered with Navya Technology France, NEXT Future Transportation Italy, Hi-Tech Robotic Systemz India in which electric autonomous shuttles are managed.

Virtual Reality will play a key role in assisting the development of various In-Car Infotainment & V2X communication features through diverse gesture recognition mediums which would enable to create different Autonomous Features.

Cyber Security:

The more vehicles become connected & automated, the more concern will be on Cyber Security. Recent successful hacking of Jeep Cherokee & Tesla Model-S has attracted interests among both investors & entrepreneurs to venture out in automotive cyber security. Autonomous Vehicles can be hacked even by Terrorists for causing massive damage in traffic systems. Argus Cyber Security & Karamba Security, Arilou Technologies are currently solving this problem.

| OEMs | Cyber Security |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Karamba Security ($) |

| Volvo (Geely, Volvo Ventures) | Upstream Security ($) |

| BMW (BMW I Ventures) | Upstream Security, Alitheon, Claroty($) |

| SAIC Motor (SAIC Capital) | Guardknox ($) |

| Hyundai / Kia Motors (Hyundai Ventures) | Upstream Security($) |

Electric Mobility & Charging Infrastructure:

| OEMs | EV Startups / EV Charging / Energy Analytics Software |

| Ford (Ford Smart Mobility, Fontinalis Partners) | Highland Electric ($), Spin (+) |

| General Motors (GM Ventures) | Lordstown, Nikola, Proterra ($) |

| Volvo (Geely, Volvo Ventures) | Polestar, FreeWire, Zeekr, Faraday Future ($) |

| BMW (BMW I Ventures) | ChargePoint ($) |

| Daimler | ChargePoint, Proterra, Hubject ($) |

| SAIC Motor (SAIC Capital) | WM Motor, Powerwise ($) |

| Honda (Honda Xcelerator) | Ubitricity, Moixa Technology, Virent ($) |

| Toyota ( Mirai Creation Investment) | 24M ($) |

| Hyundai / Kia Motors (Hyundai Ventures) | Ola Electric, Arrival, Rimac, HiiROC, Ampup ($) |

| Renault-Nissan-Mitsubishi | JMEV (+), Jedlix ($) |

References:

Author:

Sarthak Nayak

Sales Strategy Manager – IoT

Havells India Ltd.

Sarthak is a Sales & Marketing Professional. Currently, he is working at Havells for Smart Cities & IoT Program. In past he held positions of Product Management: Mahindra & Mahindra & Business Development Manager at Embitel Technologies for US & EU market. He also has limited exposure to Mergers and Acquisitions, P&L and Due Diligence process. Sarthak is an alumnus of NIT Rourkela & IIFT Delhi.

Published in Telematics Wire