IDTechEx: Autonomous vehicle markets 2025-2045

Autonomous Vehicles Markets 2025-2045: Robotaxis & Commercial Services, Autonomous Cars by SAE level (L0, L1, L2, L3, L4), ADAS Markets, LiDAR, Radar, and Camera, Market Forecast, Market Shares, Technology Trends.

News, October 28′ 2024

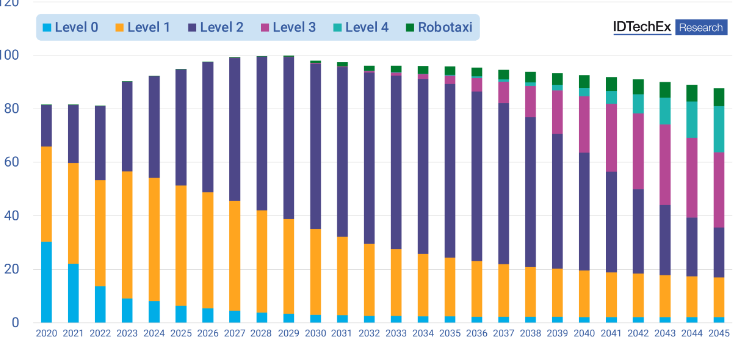

With a 20-year compound annual growth rate (CAGR) of 37% between 2025 and 2045, the worldwide robotaxi vehicle market is expected to reach a valuation of US$174 billion in 2045. Leading companies from China and the US, including Google’s Waymo, GM’s Cruise, WeRide, Baidu, and AutoX, will control the majority of the market.

Increased availability of level 2+

For many years, high component level 2 ADAS systems that offer a sophisticated highway assistance experience, including powerful adaptive cruise control and smooth lane cantering, have been referred to as level 2+. With the added benefit of allowing drivers to take their hands off the wheel while still keeping an eye on the road, it has now developed into a reliable transitional tool between level 2 and level 3.

The market for hands-free driving in private automobiles has expanded dramatically in recent years. Since 2017, the market has existed thanks to General Motors’ initial Super Cruise systems. More than 20 General Motors cars will have Super Cruise by 2024, and the system will be able to be used on 750,000 miles of recorded roadways. By being the first OEM to provide level 2+ throughout Europe with its BlueCruise technology, Ford has also achieved a noteworthy milestone. The extent to which businesses are providing level 2+ hands-off, eyes-on technologies, their range, and the regulations and guidelines pertaining to level 2+ deployment in each location are all covered in this research.

level 3 difficulties:

Eyes-on turns into eyes-off, which is the main distinction between level 2+ and level 3. This essentially means that if something goes wrong when the car reports that it is running at level 3, the OEM is held accountable. Mercedes and BMW are now the only OEMs that are willing to embrace this; the former has certified level 3 driving in Germany, California, and Nevada, while the latter only has the technology in Germany.

Since 2021, Level 3 has been permitted on public roads, with Honda’s limited introduction in Japan. Mercedes then obtained German and US certifications for its system in 2022 and 2023, respectively. Since then, Mercedes has declared plans to increase its top operating speed from 60 kph (about 40 mph) to 95 kph (about 60 mph), and BMW has received German certification. IDTechEx anticipated that more regions will receive level 3 certification by the end of 2024 and that more businesses, particularly GM and Ford, would certify their technology. IDTechEx’s projections show that progress has been far slower than first anticipated. Level 2+ is currently viewed by IDTechEx as a more important development path, and level 3 is probably going to gain traction in the next years.

In light of level 3 cars’ sluggish start, IDTechEx now anticipates that their adoption and deployment will proceed far more slowly than first anticipated. For information on the technologies available on these vehicles, all the regulations pertaining to level 3 deployment, and IDTechEx’s forecasts for the spread of level 3 technologies, view the complete report.

Robotaxis is ready to embark on a major phase of expansion.

With several commercial autonomous robotaxi services going online in China and the US in the last few years, the robotaxi sector is maturing. Important companies in these areas, including Waymo from Google, Cruise from GM, Apollo Go from Baidu, and Zoox from Amazon, have now accrued tens of millions of miles of real-world driving experience. Together, these businesses already operate over 2,000 robotaxis, gathering data to support AI drivers, demonstrating the safety of autonomous vehicles, and providing mobility as a service to clients. Baidu, for instance, has 500 robotaxis in Wuhan that serve consumers, with plans to increase to 1,000 by the end of 2024.

IDTechEx anticipates at least a few new provider and location combinations to launch each year now that commercial autonomous robotaxi services are well-established; Waymo, for instance, has already been verified in Austin and Atlanta. This will soon lead to a rush of cities and services in the US and China. According to IDTechEx, sales of robotaxi vehicles are predicted to reach US$174 billion in 2045, a 37% compound annual growth rate from 2025.

IDTechEx anticipates that autonomous robotaxi services will soon start in Europe and Japan in addition to the US and China; the entire report details when this is expected to happen.