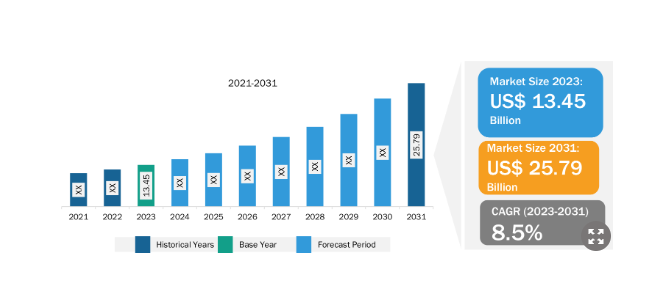

Commercial vehicle wiring harness market to be $25.79 billion by 2031

The global commercial vehicle wiring harness market is set for explosive growth, with projections indicating a surge to $25.79 billion by 2031. This remarkable expansion, driven by the rise in the demand for electric vehicles (EVs) worldwide, particularly due to the strong government policies that support its adoption and growing environmental concerns.

Press Release,October 28, 2024

The rise in the demand for EVs is fueling the growth of the commercial vehicle wiring harness market, as wire harnesses play a vital role in handling the energy and information flow in vehicles. In addition, the growing integration of advanced features such as self-driving cars and advanced driver assistance systems (ADAS) is further fueling the growth of the market.

The report runs an in-depth analysis of market trends, key players, and future opportunities. The growing integration of fiber optics for high connectivity and increasing demand for sustainability in wiring harness production is anticipated to create an opportunity for the growth of the commercial vehicle wiring harness market.

Market Overview and Growth Trajectory:

Commercial Vehicle Wiring Harness Market Growth: According to an exhaustive report by The Insight Partners, the Commercial Vehicle Wiring Harness Market is experiencing significant growth, driven by the rise in the demand for EVs. The market, valued at $13.45 billion in 2023, is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during 2023–2031.

Rise in Demand for Electric Vehicles: Electric vehicle (EV) sales are increasing due to concerns regarding environmental protection and government policies favoring the adoption of low-emission or zero-emission vehicles. Also, governments of different countries are offering subsidies and tax rebates to citizens to increase the adoption of EVs. The government authorities are taking various initiatives to promote EVs globally. The number of new electric car registrations reached 8.1 million in China in 2023, increasing by 35% compared to 2022. China is the world’s largest EV producer, producing 64% of global EV volume. Thus, the rise in sales of EVs boosts the demand for wire harnesses as they play a vital role in handling the energy and information flow within EVs, fueling the growth of the commercial vehicle wiring harness market.

Technology Advancements: Vehicle manufacturers are continuously working on the development of new technologies and their integration into modern vehicles. With the rising demand for safety and security, automotive manufacturers are integrating advanced technologies such as self-driving cars and advanced driver assistance systems (ADAS), which are changing the way of commute. This technology helps drivers by offering features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking. Also, the demand for the integration of screens and displays in commercial vehicles’ interior surfaces is increasing, which demonstrates that vehicles are growing into a hub for entertainment, communications, and productivity. Thus, the growing integration of advanced features in vehicles is increasing the addition of a multitude of hardware, including wires, cables, and connector.

Integration of Fiber Optics: The growing reliance on fiber optic cables is becoming a cornerstone of innovation and efficiency in the rapidly changing automobile industry. As automobiles become more connected with new technology, the use of automotive fiber optic cables becomes critical in addressing the increased need for quicker data transmission and better performance. Fiber optic cables boost in-car entertainment and information systems, providing passengers and drivers with an unrivaled audio-visual experience that dramatically increases user happiness and overall driving experience. Thus, the growing integration of fiber optics in vehicles is expected to boost the demand for wire harnesses, propelling the growth of the market during the forecast period.

Geographical Insights: In 2023, Asia Pacific led the market with a substantial revenue share, followed by North America and Europe. Asia Pacific is expected to register the highest CAGR during the forecast period.

Commercial Vehicle Wiring Harness Market Segmentation, Applications, Geographical Insights:

- On the basis of vehicle type, the commercial vehicle wiring harness market is segmented into electric vehicles, automotive, light commercial vehicles (LCV), and medium and heavy commercial vehicles (MHCVs). The automotive segment held the largest share in the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for light commercial vehicles (LCVs) is sub segmented into SUVs, pickups, mini-trucks, and minivans. The SUV segment held the largest share in the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for medium and heavy commercial vehicles (MHCV) is sub segmented into medium and heavy trucks, heavy mining vehicles, heavy construction vehicles, heavy agriculture vehicles, and medium agriculture vehicles/tractors. The medium and heavy trucks segment held the largest share in the commercial vehicle wiring harness market in 2023.

- The Commercial Vehicle Wiring Harness market is segmented into five major regions: North America, Europe, APAC, the Middle East and Africa, and South and Central America.

Key Players and Competitive Landscape:

The Commercial Vehicle Wiring Harness Market is characterized by the presence of several major players, including:

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Spark Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

- Furukawa Electric Co Ltd

- Lear Corp

- DRÄXLMAIER Group

- ECOCABLES

These companies are adopting strategies such as new product launches, joint ventures, and geographical expansion to maintain their competitive edge in the market.

Commercial Vehicle Wiring Harness Market Recent Developments and Innovations:

- “Lear Corporation, one of the global automotive technology leaders in Seating and E-Systems, announced that it has acquired M&N Plastics, a privately owned, Michigan-based injection molding specialist and manufacturer of engineered plastic components for automotive electrical distribution applications.”

- “Furukawa Automotive Systems Inc. installed aluminum electrical wire for the first time in WHs for automobile seats, using the superbly corrosion-resistant Alpha Terminal Series. Toyota Boshoku adopted the WHs in its automobile seats.”

- “Yazaki Corporation and Toray Industries, Inc. announced that they have jointly developed a recycled polybutylene terephthalate (PBT) resin grade that uses scrap materials from manufacturing processes to make connectors for automotive wire harnesses.”

- “Japan’s Sumitomo Wiring Systems divested a 4.4% stake in Samvardhana Motherson International Ltd for US$ 36.3 million through open market transactions.”

- “Yazaki Corporation (Yazaki) and NEC Corporation have conducted a demonstration experiment using the “NEC Digital Robot Planning Solution” to automatically generate motion plans for multiple robots using AI in the manufacture of wire harnesses for automobiles.”

Commercial Vehicle Wiring Harness Market Drivers and Opportunities:

The expanding transportation industry and the growing production of commercial vehicles drive the market in the region. For instance, according to Atradius N.V. data published in April 2024, the transportation and logistics industry is expected to grow by 6.3% by the end of 2024. Countries such as Australia, Singapore, China, India, and Japan show robust growth in their transport network. Australia and Singapore show a growth of 5%. Transportation and logistics in India are projected to grow by 8.9% in 2024 and 7.5% in 2025, owing to continuous improvements in infrastructure and transportation networks. China’s freight sector is expected to grow by 6% in 2024 and 2025. This growth is driven by favorable government support and the expansion of the transportation industry. Japan’s transportation sector is expected to rise by 6.2% in 2024. The growing freight, logistics, and transportation industry encourages automotive manufacturers to increase their commercial vehicle production.

According to the International Council on Clean Transportation Europe, ~10.6 million vehicles were manufactured in 2022 in Europe. Light commercial vehicles (LCVs), trucks and buses, and passenger cars accounted for 10%, 3%, and 87% of total market share in 2022, respectively.

Challenges and Future Outlook:

Performing a lifecycle analysis can enable engineers to detect and manage the environmental implications of wire harnesses across their entire lifespan. This analysis can help reduce the product’s carbon footprint, from material extraction to production, usage, and disposal at the end of life. Moreover, decreasing energy usage throughout the production process is an important part of sustainable design. Wire harness engineers can help by creating devices that use less energy or by modifying existing processes for greater efficiency. Also, novel solutions, such as using materials that sequester carbon, can help push the boundaries of sustainable design. Wire harness engineers might look into regenerative approaches that reduce harm and have a positive environmental impact. Thus, the rise in demand for sustainability in the wiring harness production process is expected to create an opportunity for the commercial vehicle wiring harness market growth in the coming years.

Conclusion:

The smart wiring harness system is suited for a wide range of vehicles, including military, mining, and public vehicles, as well as industrial and earthmoving equipment. Smart wiring harnesses are compact, easy to install, and maintain. In addition, harness design changes can be performed using the system’s built-in diagnostic capability and standardized components for all vehicle types. Further, a smart wiring harness does not require fuse boxes and timer relays, which helps make the system lightweight. Also, the electronic fuses present in the harness can be reset. Moreover, a smart wiring harness provides ease of installation, maintenance, and expansion and has standardized harness components. It also offers customizable vehicle body control functions, making it compatible with all types of vehicles, and provides improved safety by real-time fault reporting. Additionally, smart wiring harnesses help in monitoring the health and performance of a number of vehicle components while also performing diagnostics and preventative maintenance. This can further help improve the efficiency of vehicle maintenance, which adds to better dependability and less downtime. All these benefits of smart wiring harnesses and their compatibility with different vehicles are expected to fuel their demand in the coming years, propelling the growth of the commercial vehicle wiring harness market.

With projected growth to $25.79 billion by 2031, the Commercial Vehicle Wiring Harness Market represents a significant opportunity for component providers, system technology integrators, investors, system manufacturers, and industry stakeholders. By staying abreast of market trends, embracing innovation, and focusing on quality and performance, companies can position themselves for success in this dynamic and evolving market landscape.