AECC & GSMA unveil edge computing research

Wakefield, Mass. – Feb. 8, 2024 – The Automotive Edge Computing Consortium (AECC) and GSMA Intelligence collaborated on report titled “Edge: Coming to a Place Near You.”

The report paints a positive picture for the future of edge computing, highlighting its potential in various industries and improve our daily lives (~Bard, Google).

Key findings:

- Demand is expanding: Businesses in traditional sectors like automotive and transportation are embracing edge computing alongside newer markets like consumer electronics, media, smart cities, retail, and healthcare.

- ROI potential: The report finds significant return on investment (ROI) opportunities for implementing edge solutions, with benefits like improved operational efficiency, faster decision-making, and enhanced customer experiences.

- Market growth: The edge computing market is expected to reach $350 billion by 2026, indicating its rapid expansion.

Areas of Impact:

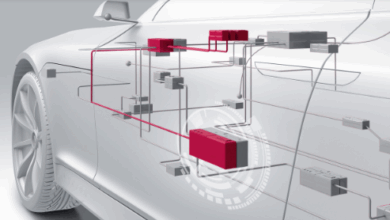

- Automotive: Self-driving cars, connected vehicles, and advanced driver-assistance systems (ADAS) will rely heavily on edge computing for real-time data processing and decision-making.

- Smart cities: Edge computing will enable faster traffic management, intelligent infrastructure, and optimized resource allocation for utilities.

- Retail: Personalized shopping experiences, real-time inventory management, and fraud detection are some applications expected to benefit from edge solutions.

- Healthcare: Remote patient monitoring, real-time medical data analysis, and improved care delivery are potential areas of edge adoption in healthcare.

Along with this research, the AECC is also announcing the appointment of Dr. Ryokichi Onishi, a Principal Engineer and General Manager at Toyota Motor Corporation, to AECC President and Chair.

The majority of surveyed companies expect a rise in capital spending. They project a 10-15% increase in edge budgets for 2024 compared to 2023. Notably, 12% of these companies plan a more ambitious approach, aiming for a surge of 20% or more.

“Edge investments are set to increase. Moreover, the research reveals a robust expansion in the demand for edge computing, primarily fueled by enterprises undergoing digital transformation. An impressive 73% of surveyed companies across five industries express their intent to increase edge investments over the next 12 months,” said GSMA Intelligence Head of Research Tim Hatt.

The report predicts significant revenue growth from the implementation of edge computing in connected vehicles over the next three years. This growth is expected to occur in the automotive sector. About 15% of automakers expect a notable 16-20% increase. This paves the way for innovative business models for Mobile Network Operators (MNOs), Original Equipment Manufacturers (OEMs), Cloud Providers, and App Players. These models will be driven by use cases requiring proximity to end-users. Notably, 44% of respondents, including mobile operators, IoT service providers, and systems integrators, express interest in conducting use-case analysis through AECC.

“Cross-industry collaboration is key. Understanding end-user requirements remains pivotal for the successful implementation of edge computing, especially for connected vehicle services,” emphasized Dr. Onishi, AECC President and Chair. Dr. Onishi brings 22 years of engineering experience to the AECC. He has a strong focus on digital infrastructure for emerging services such as data-driven vehicle design, high-definition maps, intelligent driving systems, and remote control of automated driving.

“We begin by identifying challenges, remaining receptive to solutions, and then validating promising ones through PoCs. This distinctive approach fosters a strong sense of community within AECC. It also establishes valuable partnerships with other enabling entities and communities. I invite organizations to join the AECC, collaborate with our member companies and utilize this research for informed strategic decision-making,” continued Dr. Onishi.

Other key findings from the GSMA Intelligence Survey include:

- Connected Vehicle Innovation: The report reveals that the automotive industry is a catalyst for edge investments. It continues to spearhead innovation in connected vehicle services. The report identifies a surge in demand for services such as intelligent driving, Mobility as a Service (MaaS), and Vehicle-to-Everything (V2X), amplifying the RoI potential. Notably, HD mapping and MaaS are recognized as key drivers for substantial revenue opportunities.

- Who Should Pay for Infrastructure?: The survey highlights that approximately 50% of companies view telco operators as the primary group responsible for investments in edge infrastructure. Two-thirds of operators validate this view themselves. Next come IoT providers and systems integrators at 43%, followed by equipment vendors at 31%.

- Proof of Concepts Scale Monetization: Survey findings highlight the critical role of scaling edge computing. Intensifying PoC development and testing efforts facilitate the deployment of standardized software solutions. This approach not only caters to enterprise demands across diverse verticals but also serves as a crucial step in validating ROI projections. In fact, 61% of respondents note an increase in PoC development and testing as a first and second priority for scaling edge computing; 58% note boosting the development of compelling edge use cases as a first and second priority; and 49% prioritize strengthening cross-industry collaboration on edge infrastructure as a first and second priority.

News related to AECC –