Primer on Active Safety Systems & ADAS

ADAS origin dates as far back as 1948, when the first modern cruise control was invented. In present time, Advanced Driver Assistance Systems (ADAS) has become one of the fastest-growing automotive electronics segments. It has reduced the complexity of driving, with features such as lane monitoring, emergency braking, stability controls, and others. According to MarketsandMarkets, the global ADAS market size is projected to grow from USD 27.0 billion in 2020 to USD 83.0 billion by 2030, at a CAGR of 11.9%. Increasing demand and compliance with upcoming safety mandates for semi-autonomous driving systems will drive the market for ADAS. The governments of Asia-Pacific region have recognized the growth potential of the automotive industry and have taken different initiatives for active safety system. The Ministry of Land, Infrastructure, Transport and Tourism (MLITT, Japan), announced plans to mandate AEB for all new passenger cars by November 2021. The Ministry for Road Transport and Highways (MoRTH, India) planned to adopt ADAS features by 2022. Tier 1 manufacturers are collaborating with OEMs in India to support the implementation by 2022-2023.

Mentioned below are some of the active safety systems and ADAS-

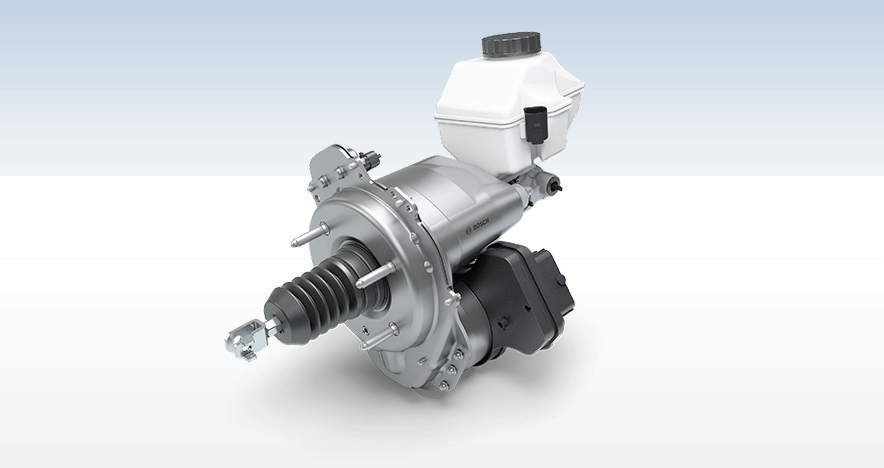

Anti-Lock Braking System (ABS)

As an Active Safety System, Anti-lock Braking Systems have been around since the late 1920s. In 1929, the first anti-lock brakes were invented by Gabriel Voisin, 1929 to solve the problem airplanes had with braking. But it wasn’t until several years later that they were successfully developed for cars.

It took a decade after the first ABS brakes for cars were developed in the 1960s until the first reliable such brakes were invented. Jensen FF and Ford Zodiac were the first commercial vehicles with ABS brakes. Chrysler, co-developing with Bendix Corporation, introduced the 1971 Imperial with their ‘Sure Brake’ system, rest is the history.

According to Mordor Intelligence report, the automotive anti-lock braking system market is expected to register a CAGR of over 7.5% during the forecast period (2020 – 2025). Asia-Pacific is one of the fastest-growing markets globally. In 2017, the Ministry of Road Transport and Highways (MoRTH) in India mandated the ABS for all new passenger cars from April 2019.

In the automotive anti-lock braking system market some of the major players are Robert Bosch GmbH, Autoliv Inc., Continental Reifen Deutschland GmbH, DENSO Corporation, and ZF Friedrichshafen AG.

Electronic Stability Control (ESC)

Electronic stability control (ESC), also referred to as electronic stability program (ESP) or dynamic stability control (DSC), provides traction and anti-skid support in cases of oversteering and understeering. ESC systems work by using ABS brakes as a foundation and with the addition of sensors measure steering wheel angle, yaw rate and turning force.

ESC’s first version was traction control that developed in the late 1980s by BMW and used the engine control system to reduce torque in “stability critical” situations. By 1992 Mercedes was in development and testing of ESC with supplier Bosch. Auto giants like Ford, Mercedes, Toyota and others were not behind. Ford referred their ECS system as Interactive Vehicle dynamics (IVD).

It was not until 2020 that the Indian government mandated the new cars in India had to be equipped ESC by amending the Motor Vehicle Act and other measures. In addition to ESC the government is expected to add autonomous emergency braking in the list in 2022-2023. The other G-20 countries that are not complying with the ESC norms set by the UN are Argentina, Brazil, China, Indonesia, Mexico, and South Africa.

According to Global Market Insights, ZF Friedrichshafen, Robert Bosch GmbH, Autoliv Inc., Continental AG, Hitachi Automotive Systems Ltd., Johnson Electric, and WABCO are some of the leading players in the electronic stability control system market. WABCO launched its ESC systems for commercial vehicles in India, in October 2017. In September 2018, ZF Friedrichshafen announced that it is expanding its safety system product offerings as well as manufacturing capacity in India to cater to the growing demand for safety systems in the country.

Electronic Brakeforce Distribution (EBD)

EBD maximizes the effectiveness of brakes and allows the rear brakes to apply a greater proportion of the braking force. It alters the distribution of the vehicle’s braking force in accordance with the rear wheel’s load condition and speed.

EBD is a sub system of the vehicle’s anti-lock braking system and electronic stability control (ESC). The EBD system uses the ESC and ABS to determine the brake force distribution to all four wheels at the time of braking. EBD uses the vehicle’s yaw sensor to detect the pitch and roll of the vehicle through a turn.

Most modern day cars with ABS and ESC have some sort of EBD system that will distribute the brake force evenly based on the driving situation. In India Maruti Suzuki S Presso, Datsun Go D, Honda Jazz V and many more comes equipped with ABS, ESC and EBD.

Brake Assist (BA)

Brake assist or Emergency Brake Assist (EBA) or Predictive Brake Assist (PBA) is designed to help drivers come to a stop more quickly during an emergency braking. It usually works in combination with ABS to help make braking as effective as possible while avoiding wheel lockage.

In 1996, Brake assist was first introduced in high-end European vehicles. BAS premiered to the world on the Mercedes-Benz S-Class and SL-Class, in December 1996. In 1998 Mercedes-Benz made Brake Assist standard equipment on all its models; other brands including Volvo and BMW soon followed suit.

According to Mordor Intelligence, the automotive autonomous emergency braking system market is expected to register a CAGR of over 7% during the forecast period (2020 – 2025). Many OEMs are equipping their products with emergency braking systems in most medium and luxury cars segment. In 2017, Toyota equipped 50% of its vehicle fleet with an emergency braking system. Significant players operating in the global automotive brake assist system market include Continental AG, Robert Bosch GmbH, WABCO Holdings Inc., Dana Limited, Mobileye, ZF Friedrichshafen AG, Hitachi Automotive Systems, Ltd, and AISIN SEIKI Co., Ltd.

Hill Hold Control

Hill Hold Control or Hill-Start Assist helps prevent a vehicle from rolling backward down a hill when starting again from a stopped position. HHC holds the brake for you while you transition between the brake pedal and the accelerator. In hill this feature is extremely helpful in avoiding accidents due to vehicle rolling backwards specially on a steep slope.

Source: Murata Manufacturing Co.

In 1936, it was first introduced as an option for the Studebaker President. The device, called “NoRoL” by Bendix, was available on Hudson, Nash and many other cars, by 1937. The device is offered by Studebaker and many other carmakers as either optional or standard equipment for many years. Beginning of 2005, the technology became more widely available, when Volkswagenadopted it into its mass produced cars like the Passat, Jetta,and Touareg.

Currently, it is used in vehicles having manual transmission as well as automatic and semi-automatic vehicles also. Electronic Stability Program (ESP) installed in many cars, often comes bundled with HSA.

As per the Research And Markets’ report, amid the COVID-19 crisis, the global market for Motorcycle Hill Hold Control System estimated at 606.5 Thousand Units in the year 2020, is projected to reach a revised size of 2.1 Million Units by 2027, growing at a CAGR of 19.6% over the period 2020-2027. Some of the key players in automotive hill start assist market are Robert Bosch GmbH, Continental AG, Knorr-Bremse Australia Pty Ltd, WABCO, ZF Friedrichshafen AG, Murata Manufacturing Co., Ltd.

Traction Control System (TC/TCS)

Traction control system is used to help drivers accelerate on slippery or low-friction conditions. ABS and TCS are setup with the ECU and the hydraulic modulator.

In 1987, traction control systems were first debuted on high-end vehicles, even though some powerful rear-wheel drive vehicles in the early 70s were equipped with early version of traction control. In modern time, traction control is generally available on any vehicle that has ABS since traction control was designed and built off existing ABS technology.

According to Allied Market Research, the traction control system market is expected to reach $44.14 billion by 2025 from $27.59 billion in 2017 with a CAGR of 6.7% from 2018 to 2025. Traction control system industry includes players such as, Robert Bosch GmbH, Continental AG, Autoliv, Inc., Nissin Kogyo Co. Ltd., WABCO, ZF TRW, Hyundai Mobis, Denso Corporation, Hitachi Automotive Systems, Ltd., and ADVICS Co., Ltd.

Hill Descent Control

Hill Descent Control is a controlled downhill descending technology that permits the vehicle to descend a slope at a controlled speed. It works with ABS and traction control to manage the speed of each wheel independently to maximize the grip of each wheel to the terrain.

Bosch developed the first hill descent control system for Land Rover in 1993, which introduced it as a feature of its Freelander model. The Freelander lacked the low range gearbox and differential locking features of the Land Rover and other 4WD off-road vehicles, and HDC was billed as a fix for that situation.

Four Wheel Drive

Four-wheel drive, also called 4×4 or 4WD, refers to a two-axled vehicle drivetrain capable of providing torque to all of its wheels at the same time. It may be full-time or on-demand, and is linked via a transfer case providing an additional output drive shaft and, in many instances, additional gear ranges.

In 1893, the first 4WD system was developed by British engineer Joseph Diplock, who patented a four-wheel drive and four-wheel steering system for traction engines. After six years, Ferdinand Porsche built a four-wheel drive electric vehicle. The world’s first 4×4 internal combustion engine car was the 1903 Spyker 60 HP. Early 1950s, Harry Ferguson, developed a 4WD system known as the Ferguson Formula for passenger cars in a factory near Coventry, England.

According to Research And Markets’ report, global Four-Wheel Drive/All-Wheel Drive (AWD) Vehicle market accounted for $405.04 billion in 2019 and is expected to reach $695.93 billion by 2027 increasing at a CAGR of 7.0% during the forecast period. Based on the technology, the four-wheel drive (4WD) segment is likely to have a huge demand due to it is generally used on large SUV Four-Wheel Drive (4×4) vehicles designed to use the extra traction of four-wheel drive in off road conditions.

Differential Lock

Differential locks allow both wheels to travel at the same speed, so when traction is lost for one wheel, both wheels will still keep spinning regardless of the amount of resistance. These can be added to either the front or rear axle, or even both axles if you’re planning on performing some hardcore off-roading. The differential lock is found in all modern passenger vehicles, commercial vehicles, and electric vehicles.

Manufacturing Holdings, Inc.

According to Allied Market Research, the worldwide automotive differential market was valued at $22,390.84 million in 2019, and is projected to reach $31,637.92 million by 2027, registering a CAGR of 4.4%. Asia-Pacific was the highest revenue contributor, accounting for $9,361.61 million in 2019, and is estimated to reach $13,983.96 million by 2027, with a CAGR of 5.4%. Market players, like American Axle & Manufacturing, Inc. (AAM), BorgWarner Inc., Dana Incorporated, Eaton, Hyundai Wia Corporation, JTEKT Corporation, Linamar Corporation, Melrose Industries PLC, Schaeffler Group, ZF Friedrichshafen AG, and others hold major automotive differential market share.

Limited-slip differentials are considered as an alternative of differential lock because they operate more smoothly, and they do direct some extra torque to the wheel with the most traction, but they are not capable of 100% lockup.

Ride Height Adjustment

Height adjustable suspension systems allow the motorist to vary the ride height or ground clearance. Height adjustment is achieved by air or oil compression replacing the “metal springs” of the vehicle, when the pressure is varied, the vehicle body rises or lowers.

Source: Continental

The first vehicle with adjustable suspension was on the 1954 Citroën 15CVH. The Range Rover offered this feature from 1993. In 2012, the Tesla Model S and Tesla Model X offered their own patented height adjustable suspension as an option. Many modern SUVs use height adjustability as a part of active suspension systems to enhance the vehicle’s versatility on and off-road.

As per Allied Market Research, the global air suspension market size was valued at $5.94 billion in 2019, and is projected to reach $9.22 billion by 2026, registering a CAGR of 6.50%. Asia-Pacific was the highest revenue contributor, accounting for $19.56 billion in 2018, and is estimated to reach $33.52 billion by 2026, with a CAGR 6.9%. Market players including Continental, ThyssenKrupp AG, Hitachi, Wabco, Firestone Industrial Products, Hendrickson, Mando Corporation, BWI Group, SAF-Holland, Accuair Suspension and others holds major air suspension market share.

Government throughout the world have made it mandatory to replace metal-based spring systems in vehicles with air suspension system keeping safety and security in mind. This has enabled vehicle manufacturers to install air suspension systems in vehicles subsequently leading to the growth of the air suspension market.

Limited Slip Differential (LSD)

A limited-slip differential (LSD) allows its two output shafts to rotate at different speeds but limits the maximum difference between the two shafts. Limited-slip differentials are used in place of a standard differential, where they convey certain dynamic advantages, at the expense of greater complexity.

In the 1930s, Ferdinand Porsche commissioned German engineering firm ZF to create a differential that would help to reduce wheel spin in Auto Union’s Grand Prix cars, as their vast power outputs easily overcame the grip provided by the narrow tires of the time.

Afterwards, the benefits of this type of differentials were exploited in cross country vehicles, but the limited-slip differential gained prominence again in the 1960s and the US Muscle Car era. These machines were built during a performance car arms race between the US manufacturers American Motors, Chrysler, Ford and General Motors.

According to 360 Research Reports, in the last several years, global market of limited slip differential (LSD) developed year by year, with an average growth rate of 4%. Global “Limited Slip Differential (LSD) Market” size is projected to reach USD 849.3 million by 2026, from USD 595.3 million in 2020, at a CAGR of 6.1% During 2020-2026. Companies Included in Limited Slip Differential (LSD) market are GKN, KAAZ, BorgWarner, JTEKT, AAM, Eaton, Quaife, DANA, Magna, CUSCO, TANHAS.

| Providers/Features | ABS | EBD | BA | ESP | HHC | TC/TCS | HDC | 4WD | DL | RHA | LSD |

| Aisin Seiki Co., Ltd | ✕ | ✔ | ✔ | ✔ | ✕ | ✕ | ✕ | ✔ | ✔ | ✕ | ✕ |

| American Axle & Manufacturing Holdings, Inc. | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✔ | ✕ | ✔ |

| Autoliv Inc | ✔ | ✔ | ✔ | ✔ | ✕ | ✔ | ✕ | ✕ | ✕ | ✕ | ✕ |

| Bosch | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✕ |

| Brakes India | ✔ | ✔ | ✕ | ✕ | ✕ | ✔ | ✕ | ✕ | ✕ | ✕ | ✕ |

| Continental AG | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✕ | ✔ | ✕ |

| Delphi Technologies | ✔ | ✕ | ✔ | ✔ | ✕ | ✕ | ✔ | ✕ | ✕ | ✔ | ✕ |

| Denso Corporation | ✔ | ✔ | ✕ | ✕ | ✕ | ✔ | ✕ | ✕ | ✕ | ✕ | ✕ |

| Eaton | ✕ | ✕ | ✕ | ✕ | ✕ | ✔ | ✕ | ✕ | ✔ | ✕ | ✔ |

| GKN Automotive | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✔ | ✕ | ✕ | ✔ |

| Hyundai Mobis | ✔ | ✔ | ✕ | ✔ | ✔ | ✔ | ✔ | ✔ | ✕ | ✔ | ✕ |

| KMP Drivetrain Solutions | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✔ |

| Mando Corporation | ✔ | ✔ | ✕ | ✔ | ✕ | ✔ | ✕ | ✕ | ✕ | ✔ | ✕ |

| MathWorks | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✔ |

| Mobileye | ✕ | ✕ | ✔ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ | ✕ |

| Murata Manufacturing Co. | ✔ | ✕ | ✕ | ✔ | ✔ | ✔ | ✔ | ✕ | ✕ | ✕ | ✕ |

| WABCO | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✕ | ✕ | ✔ | ✕ |

| ZF Group | ✔ | ✕ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✕ |

ABS- Anti-Lock Breaking System, EBD- Electronic Brakeforce Distribution, BA- Brake Assist, ESP- Electronic Stability Program, HHC- Hill Hold Control, TC/TCS- Traction Control System, HDC- Hill Descent Control, 4WD- Four Wheel Drive, DL- Differential Lock, RHA- Ride Height Adjustment, LSD- Limited Slip Differential.

Automotive head-up display

Automotive HUD is a transparent display that presents data in the automobile without requiring users to look away from their usual viewpoints. The first heads-up display was introduced by General Motors in 1988, and the systems were originally used for showing speed, tachometer and other basic readings from the dashboard. In 1989–1994, Nissan offered a head-up display in the Nissan 240SX.

The first color display appeared on the Chevrolet Corvette (C5) in 1998. Pioneer Corporation introduced a navigation system in 2012 that projects a HUD in place of the driver’s visor that presents animations of conditions ahead, a form of augmented reality (AR).

Nowadays, almost every luxury car brand offers at least an optional head-up display, that reflect some information from a small TFT panel onto the windshield, speed, GPS-guided turn-by-turn directions, what song is streaming.

According to MarketsandMarkets, the automotive HUD market is estimated to be worth USD 866 million in 2020 and is projected to reach USD 3,372 million by 2025, at a CAGR of 31.3% during the forecast period. By 2025, Asia Pacific is estimated to be the largest market for windshield HUD due to the growing demand for advanced in-vehicle technology in advanced markets such as China and India, growing demand for premium vehicles with advanced in-vehicle safety systems and a significant installation rate of windshield HUDs in mid-segment vehicles. Major automotive HUD manufacturers and suppliers of automotive HUD market are Bosch, Continental, Denso, Visteon, Nippon Seiki, Panasonic, Pioneer, Yazaki, and others.

Automotive Night Vision

Automotive night vision systems assist to alert the drivers regarding the presence of potential hazards before they become visible, through the usage of either a thermal camera or infrared light sources. These systems help in preventing accidents.

The technology was first debuted in the year 2000 on the Cadillac Deville.This technology is predicated on the night vision devices (NVD), which generally denotes any electronically enhanced optical devices operate in three modes: image enhancement, thermal imaging, and active illumination.

As per Vision Impact Institute, 60 percent of the accidents that happen globally happen due to impaired vision. India specific figures are that out of the 80 percent road fatalities in the country, at least one incident is due to vision impairment.

According to Mordor Intelligence, the automotive night vision system market is anticipated to register a CAGR of over 16.5% during the forecast period (2020 – 2025). However currently, night vision systems (NVSs) are available only for luxury cars, they are expected to be available in the mass mid-car segments by the end of 2023. Though, the high prices of night vision systems pose a significant hurdle, as the technologies used in systems, like sensors and the display units, are expensive.

According to Mordor Intelligence leading players in the market are Denso Corp., Autoliv, and Magna International.

Collision Avoidance System

Engineers have been looking at ways to prevent collisions using sensors, ince the late 1950’s. Harley Earl designed a car, named Cadillac Cyclone, equipped with a radar detection system for collision avoidance.

Source: Bosch

In 1995, Hughes Research Laboratories and Delco Electronics revealed a radar-based forward collision avoidance system. An additional technology was introduced to automotive design in 1997 by Toyota, which introduced a vehicle in Japan that included adaptive cruise control employing a laser detection system.

With the use of radar, lasers and cameras, collision avoidance alert systems provide:

- Forward-collision Warning (FCW)

- Blind-spot Warning (BSW

- Cross Traffic Warning

- Lane Departure Warning (LDW)

According to Mordor Intelligence, the automotive collision avoidance system market is anticipated to register a CAGR of about 12.11% during the forecast period (2020 – 2025). The automotive collision avoidance systems market is influenced by few players such as Continental, Delphi, Denso, Autoliv, Mobileye, Panasonic, and Hella. Toyota is the front runner in terms of the entire number of vehicles produced with a crash avoidance system. The automaker enabled 90% of its 2.5 million vehicles with it, followed by Nissan and Honda. Group of manufacturers made the voluntary commitment to equip every new passenger vehicle with the crash avoidance technology by September 1, 2022.

Image: Bosch_CA, Bosch_Blind_Spot_detection, ZF_Blind_Spot_Monitor

Intelligence Park Assist System

The automotive intelligence park assist system helps to park the vehicle safely by tracking the parking area.

Intelligent Parking Assist System (IPAS), for Toyota models in the US, was the first production of automatic parking system developed by Toyota Motor Corporation in 1999. The first version of the system was installed on the Prius Hybrid sold in Japan in 2003.In 2006, an upgraded version introduced for the first time outside Japan on the Lexus LS luxury sedan,which featured the automatic parking technology among other brand new inventions from Toyota. The system appeared on the third generation Prius sold in the U.S., in 2009

As per 360 Research Reports, automotive Intelligence Park Assist System Market size is projected to reach US 29040 million by 2026, from US 23170 million in 2021, at a CAGR of 3.8%. The key players in the global automotive intelligence park assist system include Siemens AG, Valeo, Robert Bosch GmbH, ZF Friedrichshafen AG, Magna International, Continental AG, NXP Semiconductors, Toshiba Corporation, HELLA GmbH & Co. KGaA, and Delphi Automotive.

References:

https://www.mordorintelligence.com

https://www.globenewswire.com/

https://www.alliedmarketresearch.com/

https://www.360researchreports.com/

https://www.grandviewresearch.com/

https://www.marketsandmarkets.com/https://visionimpactinstitute.org/

Richa Tyagi, Editorial Team Member, Telematics Wire

Published in Telematics Wire