Connected vehicles and the Internet of Things that really matter

The Internet of Things (IoT) has come to automotive. Having started with infotainment it has evolved to fusing sensor, positioning, cellular and short-range communications within exciting new V2X architectures that will enhance the driving experience and safety and accelerate the development of autonomous vehicles.

At a basic level V2X, vehicles can communicate critical information between vehicles, infrastructure to avoid accidents at intersections or send location information for increasingly mandatory emergency call (eCall) services.

However, the excitement is around V2X’s potential to usher in a new era of cognitive automobiles that are not only aware of their own status, but are also aware of the status of other vehicles, the environment, weather and road conditions, traffic and myriad other parameters that might affect driver safety and travel efficiency.

This automotive cognition, where sensing, communication and decisions take place at a machine-to-machine level, takes automotive transportation way beyond entertainment and classic IoT, into the realm of the “Internet of Things That Really Matter,” as one slip up along the path from a single critical sensing or positioning element, to remote analysis, to final response, could spell disaster for the driver, and potentially for the OEM.

The corollary of this is move to V2X is also true, in that by taking appropriate measures with regard to reliable, low-latency communications and incorporating proven design techniques and reliable components or modules, automotive cognition can pave the way to the Holy Grail of safe, reliable, truly autonomous vehicles. Along the way, it will enhance driver safety through more tightly integrated advanced driving assistance systems (ADAS) for collision avoidance while also enhancing the bottom line of commercial tasks such as fleet management.

Infotainment is just a starting point

From a purely technological point of view, the addition of Internet connectivity to automotive for infotainment purposes is a natural and evolutionary reaction to the movement of mobile devices from the home to the car. Automotive manufacturers recognize that consumers would like to more tightly integrate their home, mobile and automotive entertainment experience.

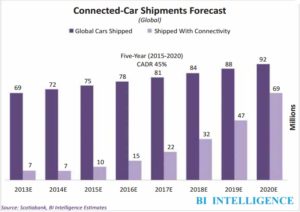

According to recent figures from Scotiabank/BI Intelligence, by 2020, 75% of the estimated 92 million cars that will be shipped will have Internet connectivity hardware, constituting a CAGR of 45% (Figure 1.)

Figure 1. By 2020, 75% of the estimated 92 million cars shipped globally will be built with Internet connection hardware, constituting a CAGR of 45%.

http://www.businessinsider.com/connected-car-forecasts-top-manufacturers-leading-car-makers-2015-3#

Applications range from streaming music and video, searching the Web, and receiving alerts of traffic and weather conditions. It puts the average selling price of a connected vehicle into the luxury range of $55,000, though prices will fall precipitously.

For its part, Gartner predicts that by 2020, more than 250 million vehicles will be connected globally – with consumer spend on in-vehicle connectivity doubling.

Interestingly, BI estimates that of the 220 million total connected cars on the road globally in 2020, only 88 million of these will have their services activated by their owners. That said, BI expects embedded connections to gain favor as not only do they circumvent use of the consumer’s data plans, but they also allow manufacturers to get information on a car’s performance and send over-the-air updates to reduce the need for recalls, a critical feature for systems that are becoming exponentially more complex as the applications of IoT for vehicles – private, public or corporate fleets – increase.

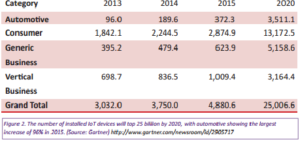

In 2014, Gartner released a study in which it calculated the total number of installed IoT devices will reach 25 billion by 2020 (Figure 2.) Of those, the automotive sector showed the highest growth rate of 96% in 2015.

Figure 2. The number of installed IoT devices will top 25 billion by 2020, with automotive showing the largest increase of 96% in 2015. (Source: Gartner)

http://www.gartner.com/newsroom/id/2905717

The applications for IoT in automotive, and transportation as a whole are many. ThingWorx, which specializes in providing easy-to-use and secure IoT device cloud connectivity, deployment, commissioning and management, points to a number of features IoT enables. These include emergency services, remote vehicle diagnostics, vehicle tracking and recovery, safe driver and no-texting services and teen driver management. It also points out that insurance carriers can use vehicle telematics data to analyze driving patterns, encourage safe driving practices and reward customers with lower premiums for good driving behaviour.

The gathering and transmission of on-board diagnostic (OBD-II) data, combined with sensors, precise positioning and driver monitoring is also critical for fleet managers, who can now track truck and driver status to make sure the truck receives maintenance before breaking down. They can also check that the driver is alert and maintaining good driving habits.

While this monitoring may have a “big brother” feel to it, for fleet managers in a very competitive environment, it can make the difference between staying in business, or not. Fuel savings, automatic tolls to save time, along with fewer breakdowns can add up quickly to reduced overall business costs.

This monitoring also sets the stage for autonomous transportation systems, which are on the horizon thanks to the work of Google, Audi, Apple, BMW, Blackberry, Ford and many others. These companies are actively engaged with each other to the point that it becomes almost difficult to separate car manufacturers from what were once “consumer” software developers. This ownership of the driving experience will be an interesting tug-of-war to watch.

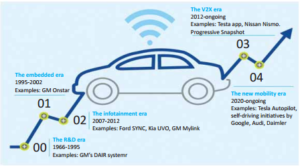

BI Intelligence also points to IoT’s use in powering driving-assistance services such as self-parking. But this is just the tip of a very large and exciting iceberg called V2X, the current stage of automotive development (Figure 3.)

Figure 3. While the addition of infotainment has been, well, entertaining, we are now well into the era of V2X, which combines ubiquitous sensors with precise positioning (POS) and cellular (CEL) and short-range (SHO) communications. This will usher in an era of unprecedented automotive cognition. (Image Source: Deloitte University Press | DUpress.com.)

A report issued in August of 2015 by a team from Deloitte Consulting LLP, led by Simon Ninan, showed the various stages of car connectivity, from early efforts with GM’s DAIR system and OnStar, through Ford’s SYNC, Kia’s UVO and GM’s MyLink, all the way up to stage 3: V2X. Next up is stage 4: Tesla Autopilot and self-driving cars.

Technologies for V2X and autonomous vehicles

Many of the technologies required for V2X are already either in place or are emerging rapidly from the labs, though automotive design cycles mean that they won’t be on the road for few years yet. Automotive design cycles of three to four years from concept to mass production are not to be confused with consumer electronics devices, with cycles of 18 months or less.

The slower design cycles for automotive can be attributed to the danger and severe liability associated with malfunctioning equipment. Recent incidences of hacking only contribute to the level of caution required. That said, compliance with standards such as ISO 26262 help ensure functional safety of automotive equipment, but compliance comes at the cost of time and money. The same goes for wireless connectivity across global regulatory requirements.

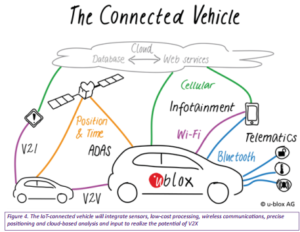

Still, the applications for V2X technologies continue to swell as developers find new ways to combine sensor data with precise positioning (POS), cellular connectivity (CEL) and short-range wireless (SHO). The result is a back up of ideas and concepts to be implemented as they’re all connected within and around the vehicle (Figure 4.)

Figure 4. The IoT-connected vehicle will integrate sensors, low-cost processing, wireless communications, precise positioning and cloud-based analysis and input to realize the potential of V2X

Along the lines of autonomous vehicles, heads-up displays providing lane-keeping assist or lane departure warning are an interesting example (Figure 5.)

Figure 5. Lane changes are particularly dangerous so for assisted or fully autonomous lane changing, a system must be aware of its own position and status, as well as the position, status and intent of other vehicles in the vicinity.

These require accurate positioning, down to 1 meter or less, as well as awareness of intent, not just of the driver, but also the intent of other vehicles. Along with accurate POS, this also requires low-latency communications of steering velocity and relative position and speed of nearby vehicles. Only when all that information is analyzed, can the onboard system indicate a go/no-go for a lane change.

The next step is hands free highway driving assistance, fully automated highway piloting, and then autonomous vehicles.

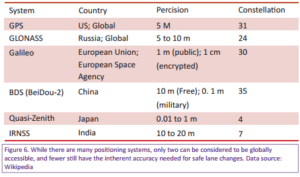

To achieve the accurate POS, there are many global navigation satellite systems (GNSSs) to turn to, though only two are considered to be truly global in capability: the United States’ NAVSTAR Global Positioning System (the original “GPS”) and Russia’s Global Navigation Satellite System (GLONASS). The others include Europe’s Galileo, China’s BeiDou Navigation Satellite System (BDS), Japan’s Quasi-Zenith and India’s IRNSS (Figure 6.)

Figure 6. While there are many positioning systems, only two can be considered to be globally accessible, and fewer still have the inherent accuracy needed for safe lane changes. Data source: Wikipedia

Even if those GNSSs were fully available to the public with no constraints, accurate positioning requires the use of multiple GNSS systems, multipath suppression, Kalman filtering, multi-frequency handling and 3D dead reckoning techniques. Datasheets generally give figures for stationary accuracy, but true POS accuracy should only be judged based on real-world dynamic performance and how well it integrates information from accelerometers, gyroscopes and ABS sensors for speed.

A good implementation will be able to enter a tunnel and have a good idea of where the vehicle is until it re-emerges using 3D dead reckoning combined with offline map matching.

Fortunately, POS systems generally receive and don’t transmit, so the designer doesn’t have to worry about US FCC, European CE or other wireless emissions regulations, but a POS receiver’s relative immunity to other interferers is a critical factor to consider.

With Europe and Russia now making eCall service mandatory to under 1 m, and the US not far behind, choosing the right POS receiver or module is now high on the list of priorities all car manufacturers.

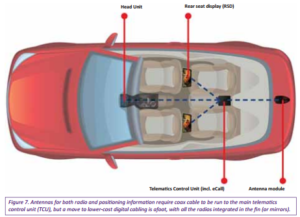

With the availability of modules, the biggest issue an OEM may now face is placement of the antenna. The sharkfin design is one popular approach.

With sharkfins, the antenna is placed atop the vehicle and coax cable is run down to the main telematics control unit (TCU). From there it can be distributed using Ethernet, wireless, or CAN bus interfaces to the head unit and rear-seat displays. In some cases, even the entire electronics is moved to the car roof in order to save expensive RF cables. This requires electronic components with extended temperature range. (Figure 7.)

Figure 7. Antennas for both radio and positioning information require coax cable to be run to the main telematics control unit (TCU), but a move to lower-cost digital cabling is afoot, with all the radios integrated in the fin (or mirrors).

While coax has traditionally been used, by integrating all the transceiver electronics in the sharkfin or in the side mirrors (for antenna diversity), lower cost digital cables can be used, though the TCU must still withstand temperatures of -40 to 105 degreesC.

These other transceivers include Wi-Fi and Bluetooth low energy, as well as cellular. While these interfaces are good for data exchange, the low latencies required for V2V, V2I and V2X communications has put the emphasis on incorporating 802.11p radios too.

802.11p is an amendment to the 802.11 (Wi-Fi) standard that allows for data exchange between high-speed vehicles and between the vehicles and the roadside infrastructure in the licensed ITS band of 5.9 GHz (5.85-5.925 GHz). It is a completely different physical layer so requires its own radio. While this means more cost in terms of physical hardware as well as software and regulatory compliance, a large chunk of that cost can be taken away using modules.

The modular approach is also interesting from the point of view of cellular operators as US-based operators require full compliance checking before a device can be allowed on their network. The reasoning has to do with making sure the device first does no harm. This is not legally the case in Europe.

Conclusion

With V2X and the Internet of Things That Really Matter, automobiles and fleet management are already the “next big technological battleground,” with plenty of opportunities for both hardware, software and services innovation. How and when we move toward fully autonomous vehicles will be determined by how these first critical steps are managed and implemented. Minimizing risk and error flows against rapid innovation, but with such high stakes, mistakes at the expense of life and lost confidence make choosing the right technology – and partners – a critical move.

References:

http://dupress.com/articles/internet-of-things-iot-in-automotive-industry/

http://www.thingworx.com/Markets/Automotive

http://www.plasmacomp.com/blogs/benefits-of-iot-in-fleet-management